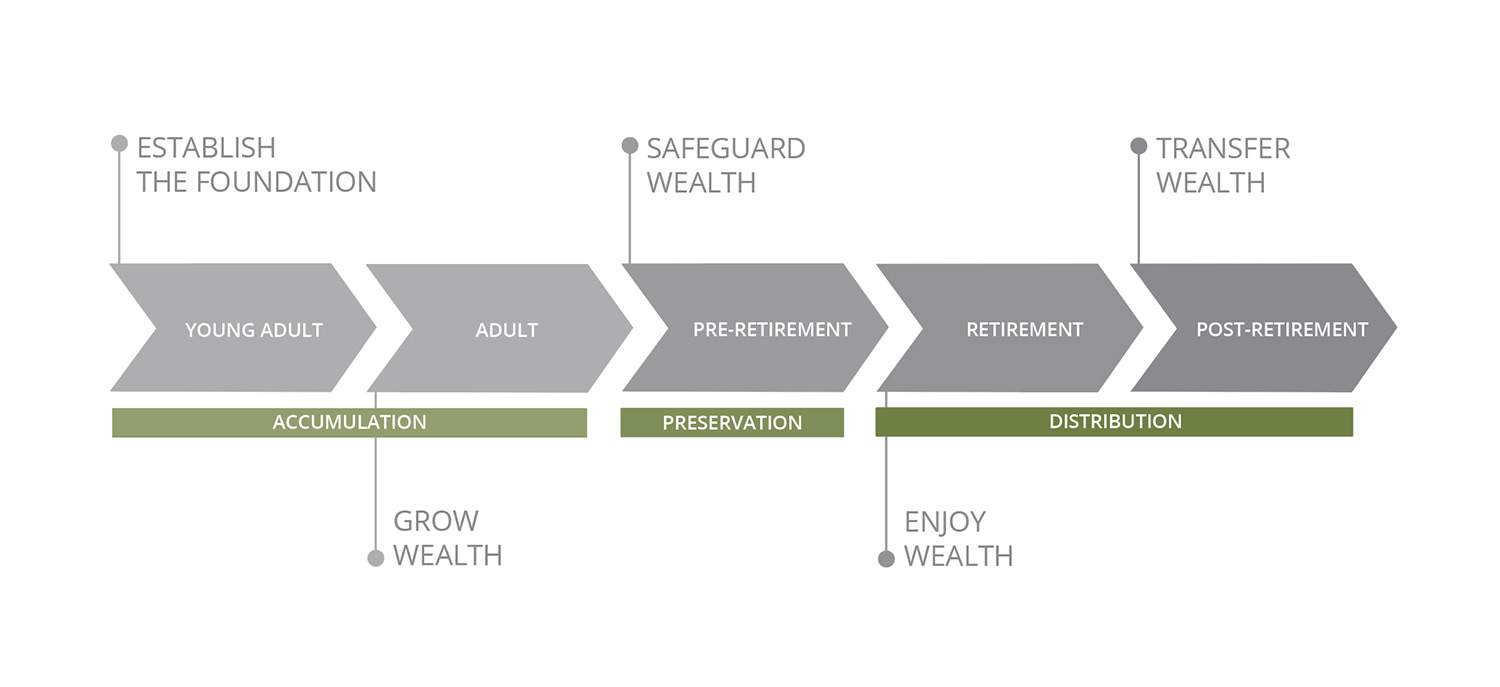

The Financial Timeline

Our financial timeline has been designed to give you a step-by-step guide for major life events that inevitably impact your finances. We aim to equip you with the professional advice, tips, and countless other resources needed to confront each phase of life head-on with sound processes and qualified support.

YOUNG ADULT

Establish the Foundation

Accumulation Phase: Whether it’s learning how to invest, establish good credit, or decipher which retirement plan is best for you, there are many boxes to check when building a flourishing financial future. In the accumulation phase of life, you’re ready to build wealth by saving your money and growing your investments.

First Job

Save for retirement – invest

TAX PLANNING & PROJECTIONS

CREATE BUDGET

MAXIMIZE EMPLOYER BENEFITS

START EMERGENCY FUND

BUILD CREDIT

Get Married

TAX PLANNING & PROJECTIONS

After getting married, have a professional run a tax projection in order to make informed financial decisions as you decide whether to file separately or jointly. (Click here to learn more about the importance of a tax projection.)

COLLEGE PLANNING – 529 ACCOUNT

As you and your spouse consider having a family, you’ll want to prepare for their education ahead of time by setting up a 529 College Savings Plan and naming yourself as beneficiary until the child is born. This will enable you to pour tax-free money into the account and allow possible grandparents to contribute.

(Click here to learn more about 529 College Choice plans.)

ESTABLISH A WILL – LEGAL

Once you get married, establish a will to name your spouse as a beneficiary and combine your assets so that they will be taken care of in the event of sudden death. You’ll also want to continue updating your will every 3-5 years. (Click here to learn the reasons for an estate plan.)

ADVANCED DIRECTIVES

Once you get married, you will want to update your Durable POA and your Healthcare POA. A spouse can make all of the healthcare decisions for their spouse without a POA, but a spouse will always need a Durable POA to transact business for the incapacitated spouse.

Buy a Home

MORTGAGE – TAX PLANNING & PROJECTIONS

When buying your first home, consider your long-term goals, the credit score of both you and your spouse, and the process of either paying for a home in cash or taking out a mortgage, which has certain tax benefits. At this time you’ll want to run a tax projection to make any adjustments. (Click here to learn why tax projections are important.)

LIFE INSURANCE

By having life insurance in place, you can ensure that your family and/or your business has a secure financial future in the event that something happens to you. Not only can life insurance provide a financial safety net for your family or business partners, but it can also be used as a retirement planning investment strategy. (Click here to learn 6 ways to utilize life insurance benefits.)

Have Children

TAX PLANNING & PROJECTIONS

(Click here to learn more about the importance of tax projections.)

COLLEGE PLANNING – 529

Once your child is born, you can move the 529 College Savings Plan to the child’s name and make contributions on their behalf. You can also withdraw funds for qualified expenses completely tax-free. (Click here to learn more about 529 College Savings Plans.)

Update beneficaries

Update WILL – LEGAL

ADULT

Grow Wealth

Accumulation Phase: By the later years of the accumulation phase, you might have already established a career and begun investing. This is the time to maximize these investments and grow your wealth substantially by contributing more money to your retirement accounts, starting or expanding a business, utilizing tax strategy to grow your portfolio, and managing any major life events such as sending a child to college or going through a divorce.

Career Changes

Save for retirement – invest

TAX PLANNING & PROJECTIONS

MANAGE FINANCIALS

START A BUSINESS

Starting a business requires multiple action items that need your attention, be it determining your tax entity or setting up a business bank account. Completing these steps correctly can save you thousands of dollars in the long run. (Click here for the new business checklist.)

GROW YOUR BUSINESS

As your business evolves and expands, you may want to consider implementing accounting software such as QuickBooks Online, completing periodic tax projections, filing 1099s, and purchasing a retirement plan for yourself or your employees. (Click here for details on how we can help you grow.)

Maturing Children

MAXIMIZE COLLEGE SAVINGS

As your children prepare to head off to college, you’ll want to maximize their financial aid and college savings by taking money out of their College Choice account, applying for FAFSA, and more. (Click here to learn more about maximizing financial aid during college.)

advanced directives

When your child turns 18, you’ll want to stay an informed parent during cases of emergency so that you can protect their interests. This includes appointing yourself as POA in medical emergencies, being named a Financial Durable POA, and acquiring access to their educational records if need be. (Click here for important tasks to complete when your child turns 18.)

Divorce

tax implications & planning

In order to capitalize on tax deductions, you may need to change your filing status, deduct alimony payments, claim child tax credits, etc. (Click here to learn how divorce adds complexity to a tax return.)

UPDATE FINANCIAL PLAN & ACCOUNTS

Create a revised budget with your single income, determine who will pay what on credit cards if you have shared debt, change beneficiary designations on necessary accounts, etc. For those with joint investment or retirement accounts, you’ll want to divide riskier investments based on differing risk tolerances as well as decide if it’s more cost-effective to liquidate your accounts rather than paying transfer or withdrawal costs. (Click here to learn about updating beneficiaries.)

UPDATE WILL – LEGAL

Adjust the beneficiaries on your accounts to include new family members if you decide to remarry someone with children.

Pre – Retirement

Safeguard Wealth

Preservation Phase: This is the time when most people start seeing retirement as a reality and begin really planning for it, including reviewing investment account risk tolerances, income need and tax strategies, identifying potential long-term insurance plans, selling or closing their business, and more.

Career Changes

SELL/CLOSE YOUR BUSINESS

5 Years Before Retirement

FINALIZE RETIREMENT PLAN

Work with your financial advisor to finalize and review your retirement plan on a regular basis. This includes building your balance sheet, identifying your retirement income need, creating a “Now, Soon, Later” plan, identifying and paying any major expenses, and completing an income gap analysis. (Click here to learn more about the “Now, Soon, Later” bucket approach.)

REVIEW INSURANCES

Decide on an insurance plan that will fit your planned lifestyle in retirement, which could include travel insurance, life insurance, lifetime annuities, long-term care insurance, and dental and vision insurance.

ESTATE PLANNING

CREATE FAMILY BINDER

REVIEW HEALTHCARE

If you don’t yet qualify for Medicare or a Medicare plan doesn’t cover everything you need, you’ll want to consider health insurance alternatives and plan for these costs. Work with your advisor to research and strategize a healthcare plan that fits your medical needs. (Click here to learn about our Medicare advisory services.)

Contribute to HSA

Contributing to an HSA is another way to fill in the gaps of what Medicare doesn’t cover. This ensures you’ll have funds for future medical expenses now and in retirement. It also prevents you from eating into retirement accounts that are intended for cost-of-living expenses. (Click here to learn more about the 5 HSA rules you need to know.)

2-4 Years Before Retirement

Annual Retirement Plan Review

REVIEW ESTATE PLAN

Reviewing your estate plan at this stage will allow you to adjust your will, designate guardians for any minor children, review your trust strategies, and take into consideration any new tax regulations. You’ll also want to consider making any charitable contributions or gifts to minimize tax liability.

UPDATE FAMILY BINDER

Discuss Healthcare Options

After reviewing your healthcare options, you’ll now want to discuss any prescription drug and disability coverage you may need as well as take an in-depth look at costs. You’ll also want to examine your taxable income a minimum of 2 years prior to enrolling in Medicare to avoid additional IRMAA fees. (Click here to learn ‘what is IRMAA’).

Discuss Optional Tax Strategies

Diversify how and when your retirement fund will be taxed by considering an HSA, implementing a Roth conversion, investing in a brokerage account, and other options. (Click here for 12 Roth IRA conversion facts.)

1 Year Before Retirement

Annual Retirement Plan Review

Meet with your advisor to discuss any life events such as career changes, raises, divorce, or death that may alter your upcoming retirement plans. This is also a great time to confirm that your risk level is still in line with your risk tolerance since you’ll have less time to recover from potential losses. (Click here to learn more.)

TAX PLANNING & PROJECTIONS

There are many investment strategies for retirement including pensions and social security, as well as traditional and Roth IRAs. Each strategy comes with a different set of tax rules. Some are taxable upfront while others are tax-deferred. Understanding tax consequences is key to making wise financial decisions. (Click here to learn more about understanding the tax implications of retirement planning.)

UPDATE FAMILY BINDER

Finalized Healthcare Insurance

After considering the scope of your coverage, various premiums, and what inclusions and exclusions may apply, it’s time to finalize your health insurance.

Allocate Cash

Set aside one year of cash to cover a full year of retirement expenses. This can be held in a liquid account such as an interest-bearing bank account, money market fund, or short-term CD. Then, you can use the money in this account and replenish it with portfolio funds.

Retirement

Enjoy Wealth

Distribution Phase: The distribution phase begins when you start implementing your retirement plan and utilizing your retirement income. At this point, it is time to enjoy the fruits of your labor, but it’s important to remember that strategizing your retirement shouldn’t stop entirely. You’ll want to meet regularly with your advisor to manage tax strategies, implement a healthcare program, start drawing on social security, and more.

Leave Career

Implement Retirement Plan

While in the distribution phase, you’ll implement the “Now, Soon, Later” plan you worked with your advisor to cultivate as well as have an annual review completed to make sure you’re utilizing your plan wisely. Your spending may change in retirement due to increased medical bills, adjustments made to your estate plan to account for new loved ones you want to leave wealth to, and other developing factors. (Click here to learn more about the bucket approach retirement strategy.)

Manage Tax Strategies

Work with your advisor to employ strategies such as withdrawing from investments in tax-deferred or tax-free accounts, taking advantage of RMDs, and tapping interest and dividends while leaving your original investments alone. (Click here to learn more about the power of Roth conversions to reduce RMDs.)

Implement Healtchare Program

Utilize the healcare program you’ve outlined. However, make sure to plan for rising healthcare costs and potential needs for long-term care. Then, you can adjust as your plan as necessary.

Maintain Cash

Maintain one year of expenses in cash and take advantage of predictable income. For discretionary expenses consider paying with stock dividends, distributions from mutual funds, and proceeds from selling investments.

Social Security

You can start drawing from Social Security at 62, but you won’t receive full benefits until full retirement age. Delaying your benefits from your retirement age to age 70 can also increase your benefit amount. (Click here to learn more in these Social Security videos.)

Medicare

You’ll want to have reviewed your Medicare options and signed up during the 7-month initial enrollment period 3 months before turning 65. Before enrolling, your advisor can examine your taxable income from the past 2 years of tax returns to help you avoid IRMAA fees. Remember that once you choose a Medicare plan, you can change it as you age. (Click here to learn more about how to avoid IRMAA fees.)

Post – Retirement

Transfer Wealth

Distribution Phase: This stage requires in-depth end-of-life planning, including maintaining your retirement plan, strategizing a tax-efficient wealth transfer plan, and making any updates to your will or estate plan.

Retirement Maintenance

Manage & Review Retirement Plan

When inflation and unexpected changes in your lifestyle occur, your spending habits will drastically change. For this reason, you should meet with your advisor to adjust your balance sheet and review your budget and portfolio annually. (Click here for a list of elements to review annually).

Manage Tax Strategies

In order to stretch out your retirement savings, employ tax-efficient strategies like taking your RMDS, tapping interest and dividends, collecting principal from maturing bonds and CDS, and selling any other assets if necessary. (Click here to learn the about power of Roth conversions to reduce RMDs.)

Legacy planning & wealth transfer

When discussing legacy planning and wealth transfer, it is important to consider the financial implications that will come to those who receive your generosity. Considering the most tax-efficient methods should be at the forefront of these discussions in order to maximize your gift and alleviate future stress. (Click here to learn about tax-efficient wealth transfer methods.)

Review Estate Plan

Reviewing your estate plan every three years will allow you to adjust your will, designate guardians for any minor children, review your trust strategies, and take into consideration any new tax regulations. You’ll also want to consider making any charitable contributions or gifts to minimize tax. (Click here for elements needed to update your estate plan.)

Update Family Binder

At least every other year, update your family binder with add new account information, passwords, and other important information. (Click here for elements needed to update your family binder.)

Review Healthcare

Make sure you’re accounting for additional costs of over-the-counter medications as well as dental and long-term care. Adjust your Medicare plan as necessary.

Review Insurances

If you travel a lot in retirement, consider the effect this has on homeowners and auto insurance. Make sure to review your plans to account for living in multiple places throughout the year. Review your long-term health insurance if you or your spouse need full-time nursing home care, as this is not covered by health insurance.

Maintain Cash

Always maintain one year of cash to cover a full year of expenses. This can be held in a liquid account such as an interest-bearing bank account, money market fund, or short-term CD. Then, you use the money in this account and replenish it with portfolio funds.

End of Life

Prepare End of Life Plan

Schedule a family meeting with your financial advisor and attorney to review the transfer on death for house and bank accounts, verify beneficiaries are updated, address any healthcare expenses, etc. (Click here to learn the 5 Steps To Prepare an End of Life Plan.)

Death

Account changes

tax implications & planning

When a loved one passes away with a certain amount of assets, a federal estate tax return is due nine months after the date of death and taxes may be owed. Consult an advisor who specializes in tax about maximizing deductions, avoiding probate, and other strategies.

execute will

Execute a will and make sure to finalize any last changes that an executor or trustee will need to enact. Ensure loved ones are taken care of as designated.

Allocate CASH / ESTATE ACCOUNT

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual.

Traditional IRA account owners have considerations to make before performing a Roth IRA conversion. These primarily include income tax consequences on the converted amount in the year of conversion, withdrawal limitations from a Roth IRA, and income limitations for future contributions to a Roth IRA. In addition, if you are required to take a required minimum distribution (RMD) in the year you convert, you must do so before converting to a Roth IRA.

This information is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

How can we help?

At Storen Financial, we offer so much more than tax preparation and accounting services. We go beyond the numbers to provide our clients with financial planning, in-depth consulting, and year-round support. Looking for more info? Click below to learn more.

LEARN MORE

Read the latest news and resources on our blog

January 2026 Newsletter

Have you read our January Newsletter? Our monthly newsletters are packed with educational resources for financial planning and retirement, business services, and tax preparation and planning. Stay up-to-date on hot topics and new regulations as well as upcoming Storen...

Blog Content Library – 2026

Quickly find the information you need in our blog library of helpful tools, tips, and resources. If you have questions about anything, please contact us. Click the title to access each blog. Financial Planning, Investments, & Personal Finance • Storen...

How to Pay Your Taxes for an Extension

Below you will find instructions on how to make your Federal and Indiana State Extension payments online. These instructions do not require an account to be set up. Please note that Extension payments are the taxes you pay when you have extended the time to file your...