Our goal is to provide educational opportunities and resources in order to help you along your financial journey. Check out our calendar and join us for one of our events!

Comprehensive & Specialized Financial Services

Storen Financial is an independent investment and accounting firm in the Indianapolis area, serving clients in 43 states. Learn how we can help you develop a comprehensive, long-term financial plan that implements customized tax-saving strategies.

Tax Planning & Preparation

Financial Planning & Investments

Business Services

Have you read this month’s newsletter?

Our monthly newsletters are packed with educational resources, hot topics and info on new regulations, as well as upcoming events and team news. (Click here to read our newsletters.)

Why choose storen financial?

A Unique Approach to Financial Services

With expertise in investing, IRAs, financial planning, tax preparation, and accounting, we offer services that cover all areas of your financial concerns under one roof.

Holistic Perspective

Fiduciary Standard

In advisory relationships, acting in our clients’ best interest is at the heart of everything we do.

Tax Expertise

Focused on helping minimize tax liabilities and maximize future opportunities in all areas.

Commitment to Education

Resources to help you along your financial journey.

Resources to help you along your financial journey.

Get to know Storen Financial…

A local institution for over 50 years with a focus on team, family, and community involvement, we pride ourselves on forward thinking innovations and dedicated customer service. We offer year-round, comprehensive options that implement tax-saving strategies to help individual and business clients pursue financial goals.

Learn more about our services, team, and core values in our welcome video…

testimonials

What are others saying about Storen Financial?

Would Recommend Without Reservation

My wife and I have been clients of Storen Financial since 2013. We have always found Brian, Joseph, and the entire team at Storen very professional, knowledgeable, and helpful. We appreciate that they are very interested in making the most of our investments and very conscientious about watching the impact our decisions have on our overall tax brackets. Brian and the entire team at Storen are never pushy or demanding and are always available to discuss any of our concerns. We are very pleased and would recommend the services of Storen Financial without reservation.*

Exceptional Experience

I am so happy that I was referred to Storen Financial. It has been an exceptional experience thus far. They have helped to insure that my business/billing is being completed correctly, that my taxes are being calculated accurately, and that overall my business is protected. My business is in the best possible position it can be in thanks to Storen Financial.*

Fantastic Team of Professionals

Storen Financial has a fantastic team of professionals that provide outstanding Tax and Accounting services for our small business. Storen has aided us in growing our business by allowing us to concentrate on operating our business to better serve our customers and increase sales/ revenue, while Storen provides us time savings and the invaluable services of business accounting and tax liability strategies. The Storen Financial staff, from the front desk to the back offices, is always kind, polite and a pleasure to work with.*

*This statement is a testimonial by a client of the financial professional as of 01/19/2024. The client has not been paid or received any other compensation for making these statements. As a result, the client does not receive any material incentives or benefits for providing the testimonial.

Learn from our QuickBooks Advanced Certified ProAdvisor

Our goal at Storen Financial is to help our business clients become more efficient, more profitable, and all around better businesses. With this goal in mind, we’ve developed training courses aimed at isolating the most commonly asked questions and setting your business up for future success.

Led by our Advanced Certified ProAdvisors, our unique training environment will allow you to gain valuable best practice experience, specific training on common functionalities, and troubleshooting tips to help maximize your efficiency.

Erika Lewis

Business Services Director

LEARN MORE

Read the latest news and resources on our blog

July 2024 Newsletter

Have you read our July Newsletter? Our monthly newsletters are packed with educational resources for financial planning and retirement, business services, and tax preparation and planning. Stay up-to-date on hot topics and new regulations as well as upcoming Storen...

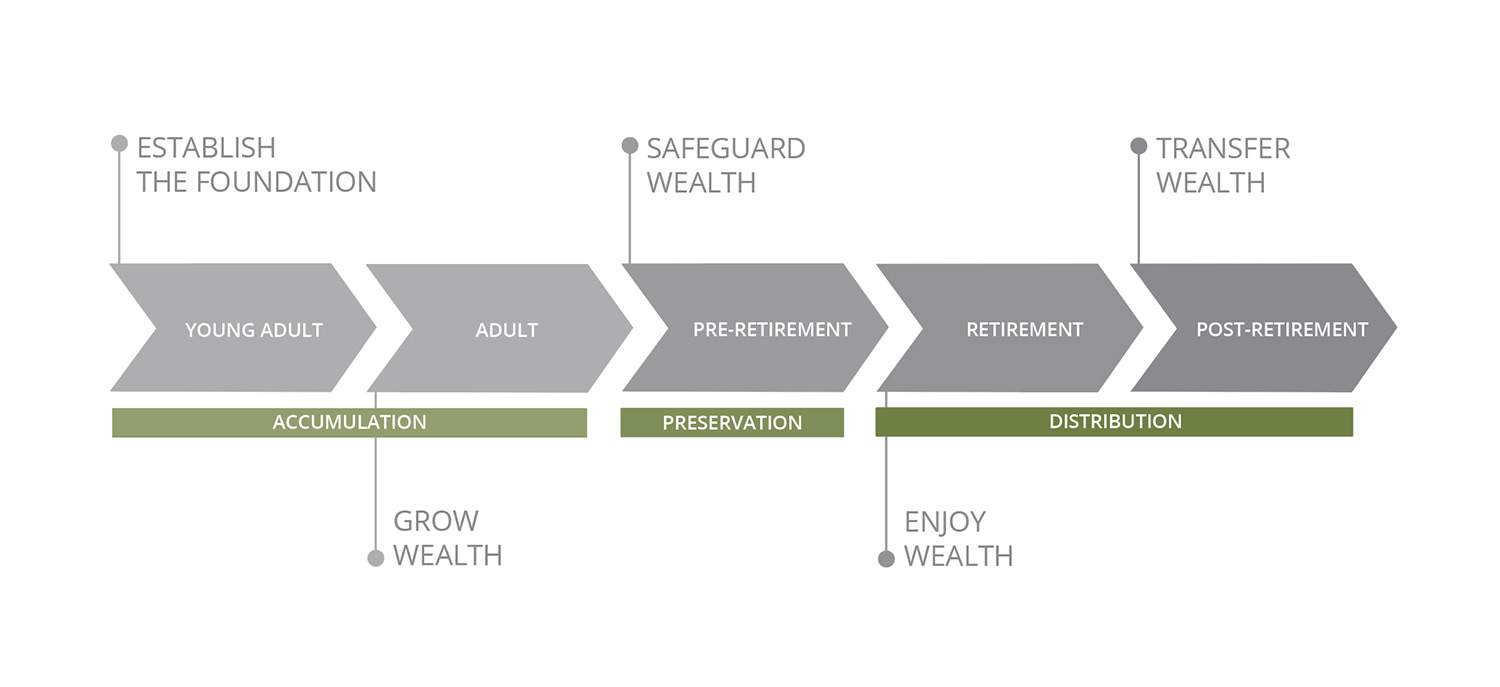

Establish a Foundation with the Storen Financial Young Professionals Program

Define your financial future with our Young Professionals Program For young professionals in their twenties and thirties transitioning from college to career, many find they may have more time to dedicate to their financial journey, but they lack the tools and...

Benefits of a Transfer on Death (TOD) Deed

Avoid Probate and Control Distribution of Non-qualified Assets After Death Probate, the legal process in which a will is meticulously reviewed to determine whether it's valid and authentic, is something most people dread. (Click here to learn more about probate.) It’s...