News & Resources

Have questions? Looking for helpful resources and links? We’ve put together these resources to help you get answers to your questions. Need more information, give us a call! Also, don’t forget to check out our blog for the latest information.

RESOURCES

Resources to help you on your financial journey

Below are the resources we’ve assembled to help you on your financial journey. Click these buttons to quickly find the information you’re looking for and please don’t hesitate to give us a call if you have any questions.

Resources to help no matter where you are along your financial journey.

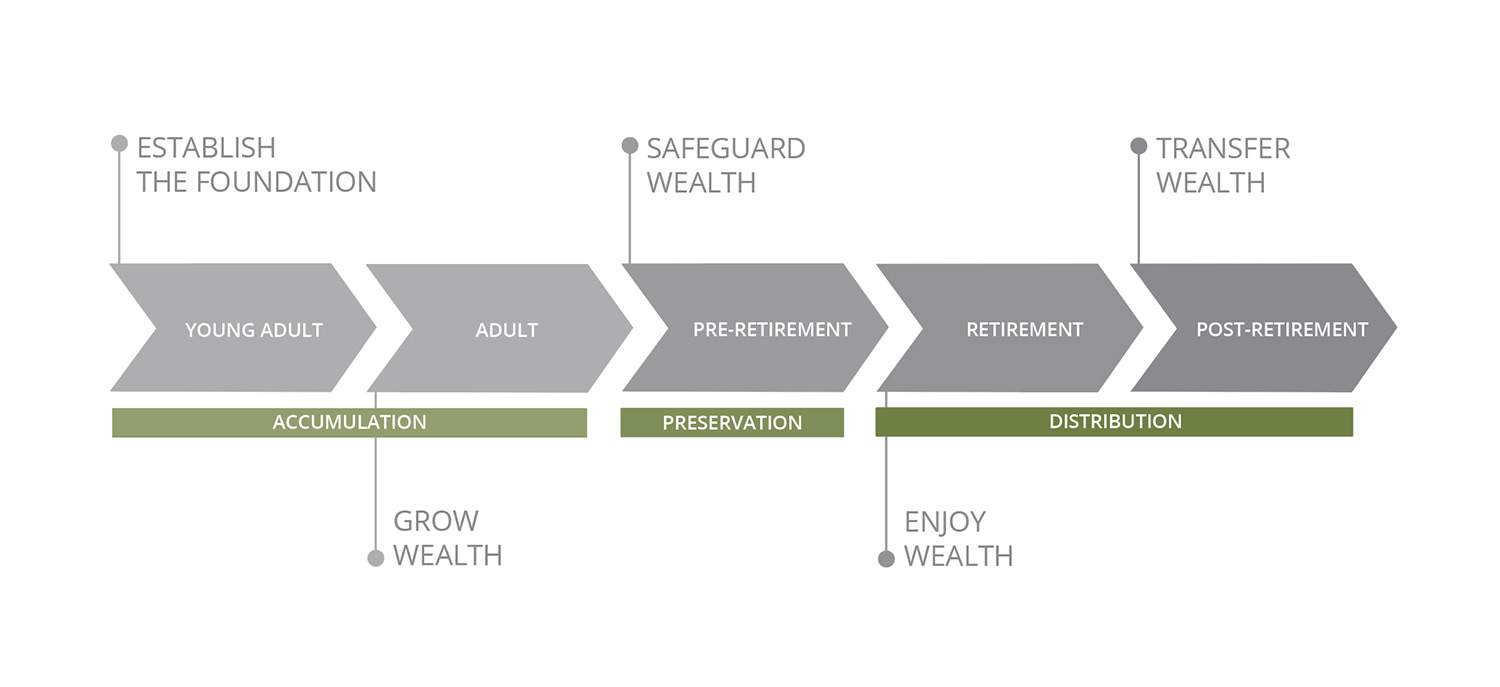

This resource provides financial recommendations through various stages of life, for young adults through post-retirement. Click here to access this guide.

BLOGS BY CATEGORY

Search our news and educational database

Our goal is to share pertinent information with you through our blogs, resource links, social media posts and updates. On our blog you’ll find all the tools, resources, and information you need. Have questions? Give us a call!

How can we help?

At Storen Financial, we offer so much more than tax preparation and accounting services. We go beyond the numbers to provide our clients with financial planning, in-depth consulting, and year-round support. Looking for more info? Click below to learn more.

LEARN MORE

Read the latest news and resources on our blog

Key Aspects of the One Big Beautiful Bill Act

How will the One Big Beautiful Bill Act affect you? The One Big Beautiful Bill Act of 2025 brings a host of changes that will sweep US tax law, affecting deductions, credits, and savings accounts across the board. To help you sift through all the legislation and...

Case Study: Streamlining Accounting Software Simplifies Your Business Books

QuickBooks Online - Hone the Skills to Maximize this Software Oftentimes, business owners come to us with pain points that can significantly impact the trajectory of their business and their tax liability. One of these situations recently occurred when we coached a...

Event: Business Resources – Operations and Documentation – 8/21

Strengthen Your Arsenal of Business Resources with This Educational Event Join us for this complimentary event, which is the perfect small-group format to explore topics crucial for equipping business owners for success. Our Storen Financial team members and special...