*Interested in reviewing this Storen Financial balance sheet? Contact us to schedule a consultation with one of our Financial Advisors!

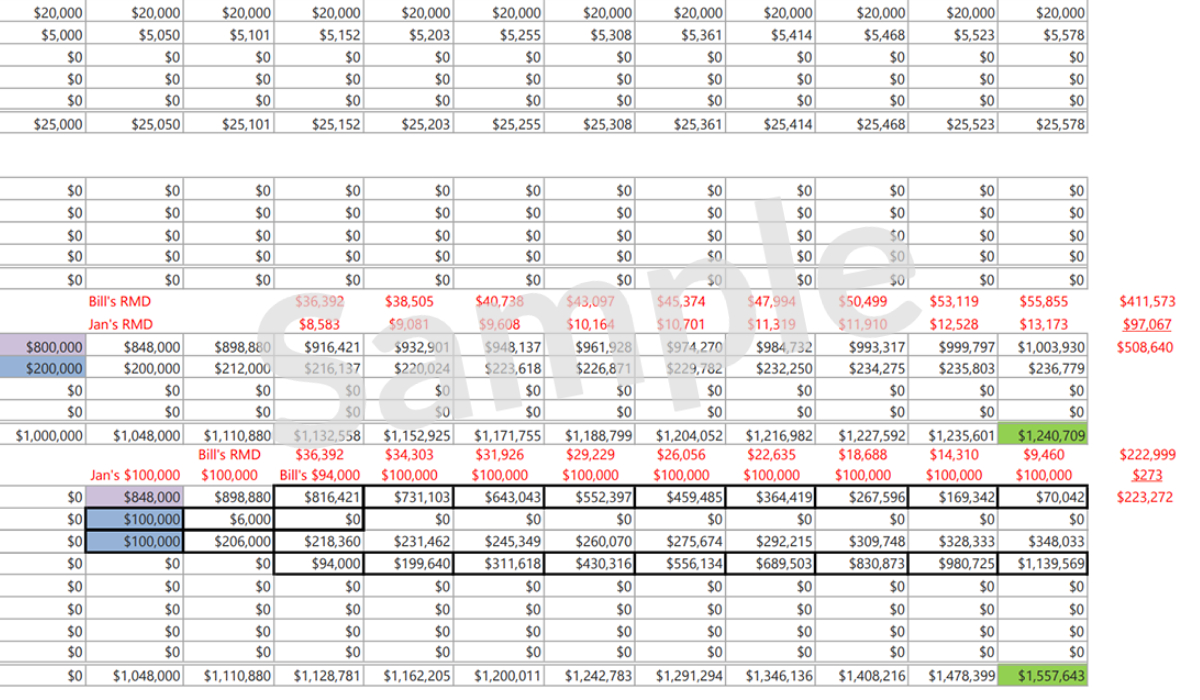

This Roth conversion plan reduced the RMD total by over $285k

Q: How do you reduce your tax liability and maximize your investments if you will not need an income stream after the age of 72?

A: Consider the Roth conversion multi-year strategy.

Using the Storen Financial multi-year balance sheet projection, we are able to see the power of the Roth conversion strategy by manipulating the fields to create different scenarios. In this example, we reduced the wife’s RMD to approximately $273, and then focused on drastically reducing the husband’s.

We limited the Roth conversions to $100k per year, to prevent a large increase in their Medicare premiums, by pushing them up into a higher premium tier. First, we calculated their RMDs each year (see in red), without any conversions, and totaled them out to the right. In their first 10 years, they would be required to take an estimated $508,640 in combined RMDs. Next, we implemented our Roth conversion multi-year plan. As a result, only he would be subject to RMDs, and over the 10 years the RMDs would be reduced to approximately $223,272… a difference of $285k!

Utilizing this plan will mean they have to pay taxes on the Roth conversions each year. If we assume an 18% tax rate they will still save approximately $170k after taxes. It’s worth mentioning here that tax rates are estimated to be higher in the future. If they plan to pass these assets on to their children as inheritance, it is important to consider the tax impact from a multi-generational standpoint. Since Roth IRAs grow tax free, their children would not have to bare the burden of paying future (possibly higher) taxes on any of the converted amounts. This is a valuable benefit since it is estimated that these accounts will continue to grow over time (for example, paying less taxes now on a $500k balance is better than paying higher taxes later on a $1m balance), even if tax rates don’t go up.

Notice that by the end of the 10 year time span they will have close to $1.5M protected from RMDs and future taxation! By contrast, without the Roth conversions, they would have approximately $1.24M subject to ongoing RMDs and future taxation.

What is an RMD?

An RMD is the minimum amount the IRS requires you to withdraw from qualified retirement accounts and IRAs beginning the year you turn 72 and each year after. The amount of each RMD is determined by dividing the combined total of all your retirement accounts as of December 31 of prior year by your IRS life expectancy factor.

Which retirement accounts have RMDs?

Required minimum distributions apply to nearly all tax-advantaged retirement accounts—with the sole exception of Roth IRAs. You must take RMDs from these accounts:

- Traditional IRAs

- SEP IRAs

- SIMPLE IRAs

- 401(k), 403(b) and 457(b) plans

- Profit sharing plans

- Other defined contribution plans

Our Team of Financial Professionals at Storen Financial will work with you to create a comprehensive plan that will help you pursue your financial goals, from retirement planning to investments and IRA’s. Learn more about our Financial Planning & Investment services here. Have questions? Want to schedule a consultation to discuss your tax-impacted financial strategy? Click here to contact us now.

Want to learn more?

Here are a few more resources to answer your RMD questions…

How You Can Reduce Your RMD – Ed Slott and Company

Retirement Plan and IRA Required Minimum Distributions FAQs – IRS.gov

4 Strategies To Minimize Your RMDs – Forbes Advisor

4 Strategies to Limit Required Minimum Distributions (RMDs) – www.investopedia.com

Traditional IRA account owners have considerations to make before performing a Roth IRA conversion. These primarily include income tax consequences on the converted amount in the year of conversion, withdrawal limitations from a Roth IRA, and income limitations for future contributions to a Roth IRA. In addition, if you are required to take a required minimum distribution (RMD) in the year you convert, you must do so before converting to a Roth IRA. The example used is for illustration purposes only. Your results may vary.

Blog by Matt Wilson – Portfolio Analyst

Learn more about Matt and the rest of the Storen Financial team here.