Why A Bucket Strategy Makes Sense for Retirees

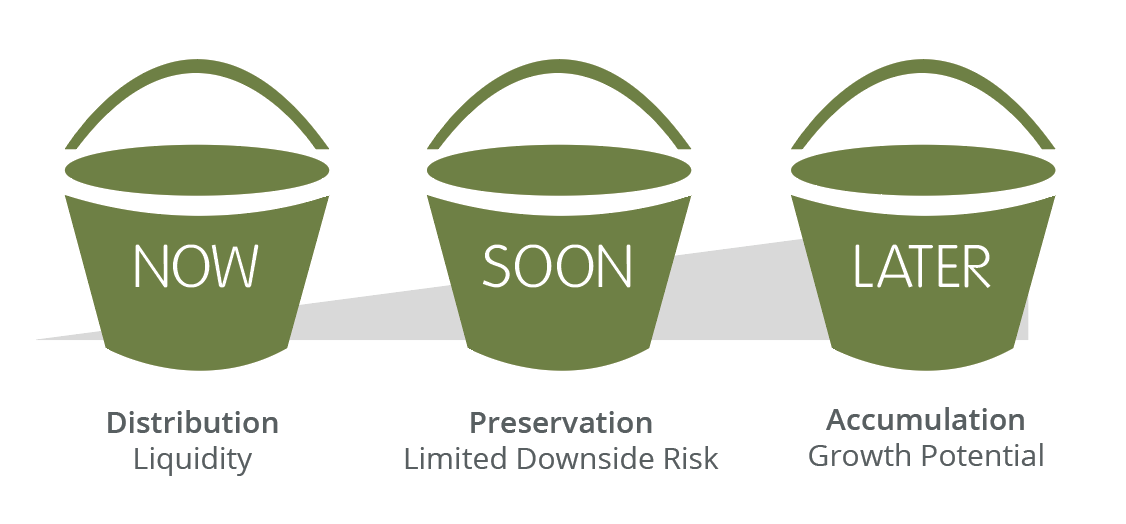

Pioneered by renowned financial planning expert, Harold Evensky, the Now, Soon, Later Approach is an asset allocation strategy that guides our qualified advisors in determining how we invest our clients’ assets. Our objective is to match an investment risk and return to our clients’ personal finance goals and their lifestyle. We take multiple factors into account, including your stage of life: Distribution, Preservation or Accumulation. The end result is a Now Bucket with liquidity, a Soon Bucket with limited to no downside risk, and a Later Bucket with growth potential.

Bucket #1 – The Now Bucket

The first bucket is the most liquid. This bucket should hold enough to cover your basic expenses for one year, minus any nonportfolio sources of income like a pension or Social Security. Adding an emergency fund to this sum is a wise possibility for more conservative investors.

Bucket #2 – The Soon Bucket

The Soon Bucket contains five or more years worth of funds to provide stability and generate income. Marked by high-quality fixed-income exposure, this bucket can also feature a smaller share of top quality dividend-paying equities and securities. As highly liquid Bucket #1 begins to empty out, Bucket #2 refills the bucket through dividends and yields.

Bucket #3 – The Later Bucket

The third bucket contains stocks and the most volatile bonds. While this bucket has the highest loss potential, it is also most likely to deliver the greatest performance over many years. This bucket will require some upkeep with your investment team to make sure the balance of equity remains intact. At Storen Financial, we sit down together and evaluate at least once a year during your annual review (Click here to learn more about your annual review).

Between rising inflation rates, a global pandemic and conflict overseas, financial markets are considerably more volatile than in recent history. This level of uncertainty can be anxiety-inducing for retired individuals on a fixed income or those looking to retire soon. In times like these, it is especially important to have a plan in place for your life’s earnings. The Bucket Approach is a simple method for categorizing your earnings as well as your savings for the short and long term, effectively creating a paycheck from your investment assets. When utilized correctly with the help of an investment team, it can provide stability and confidence that your finances are in order—no matter what is going on in the world.

If you’re interesting in learning more about how we use the Bucket Approach, contact us to schedule a consultation with one of our advisors. We’ll walk you through how this will apply to your unique situation. Or click here to learn more about our investment strategies.

Want to learn more?

Here is another resource to answer your questions…

The Bucket Approach to Building a Retirement Portfolio – Morningstar

Blog by Greg Storen, MBA – President/ CEO, Advisory Services Director

Learn more about Greg and the rest of the Storen Financial team here.

All investing involves risk including the possible loss of principal. No strategy assures success or protects against loss.