Educational Events

EVENT DETAILS

Join us at one of these upcoming events

Our goal is to provide educational opportunities and resources to our clients and surrounding community members in order to help you along your financial journey. Check back frequently as we’re always adding new events!

Event Calendar

View all of our events we have planned for the year on our event calendar. Click here for details.

Event: Business Resources – Operations and Documentation – 8/21

Strengthen Your Arsenal of Business Resources with This Educational Event Join us for this complimentary event, which is the perfect small-group format to explore topics crucial for equipping business owners for success. Our Storen Financial team members and special...

Video: What are our upcoming summer and fall events?

VIDEO: Click here to watch on YouTube. Chief Operating Officer, Debbi Kuller, shares the upcoming 2025 events for this summer and fall. Join us as Communications Specialist, Kaylee Kriese, travels around the office in search of quick answers and helpful information...

Event: Tax-Smart Distribution Strategies for Retirement – July 22

Learn More: Aim to Minimize Risk with Smart Withdrawal Strategies Join us for this complimentary event on July 22nd, where Storen Financial's Investment team will educate on the important decisions you must make when moving from the savings phase to the retirement...

How can we help?

At Storen Financial, we offer so much more than tax preparation and accounting services. We go beyond the numbers to provide our clients with financial planning, in-depth consulting, and year-round support. Looking for more info? Click below to learn more.

LEARN MORE

Read the latest news and resources on our blog

Key Aspects of the One Big Beautiful Bill Act

How will the One Big Beautiful Bill Act affect you? The One Big Beautiful Bill Act of 2025 brings a host of changes that will sweep US tax law, affecting deductions, credits, and savings accounts across the board. To help you sift through all the legislation and...

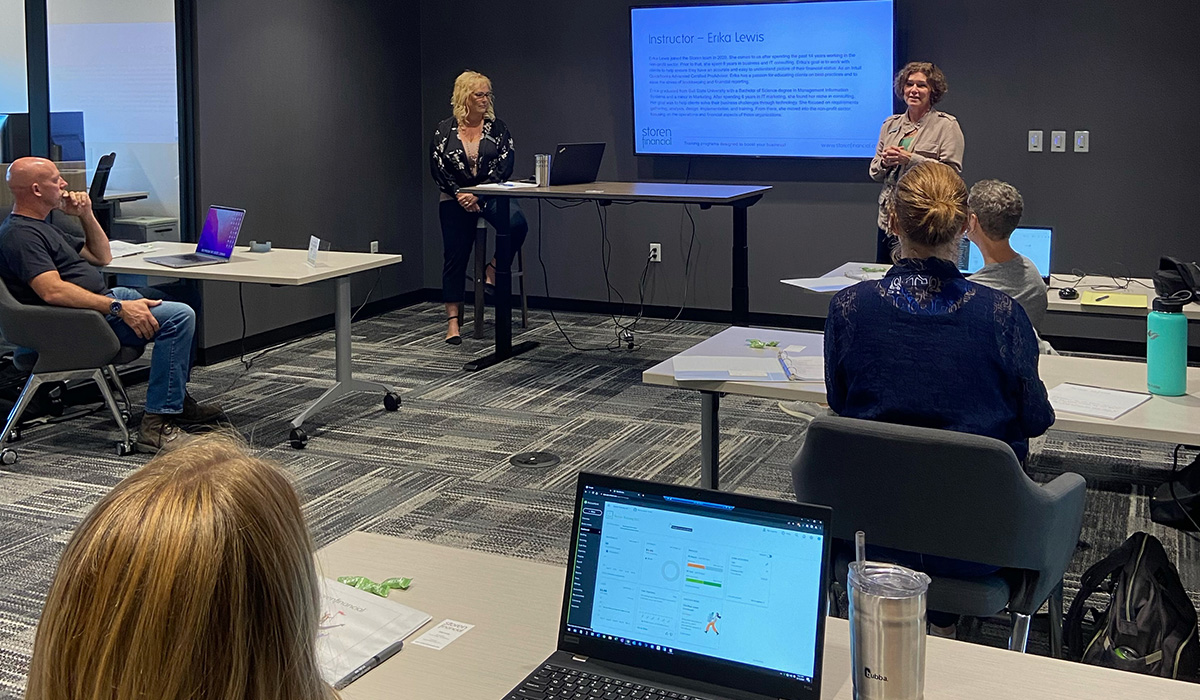

Case Study: Streamlining Accounting Software Simplifies Your Business Books

QuickBooks Online - Hone the Skills to Maximize this Software Oftentimes, business owners come to us with pain points that can significantly impact the trajectory of their business and their tax liability. One of these situations recently occurred when we coached a...

Event: Business Resources – Operations and Documentation – 8/21

Strengthen Your Arsenal of Business Resources with This Educational Event Join us for this complimentary event, which is the perfect small-group format to explore topics crucial for equipping business owners for success. Our Storen Financial team members and special...