Does your retirement plan include tax-saving strategies?

Does your retirement plan include tax-saving strategies?

Why storen financial?

Tax-Saving Investment Strategies that Focus on the Whole Picture

Our team of experienced professionals work with you to develop a comprehensive, long-term financial plan that implements customized tax-saving strategies that fit your unique situation.

These strategies not only focus on investments and stock portfolios, but factor in elements such as Medicare, Social Security, legacy planning, and much more.

Holistic Perspective

Team Partnership

Dedicated service teams focus on personalized service.

Commitment to Education

Fiduciary, in Advisory Relationships

Acting in our clients’ best interest is at the heart of everything we do.

Listen: Learn How Our Investment Philosophy and Process is Unique

Greg Storen, President and Advisory Services Director, sits down to discuss how the Storen Financial financial planning process and philosophy impact our clients’ investment portfolios. Our goal is to minimize tax in order to help them keep more of their hard-earned money. Listen to learn how we go about this…

Financial Planning - Our Philosophy & Processes

The Tax impact

Evaluating your tax exposure and plans for distribution.

We structure retirement planning to your advantage by not only helping to maximize your investment strategies, but also by considering your tax exposure and plans for distribution. There are many investment strategies for retirement including 401Ks, pensions and social security, as well as traditional and Roth IRAs. Each strategy comes with a different set of tax laws. Without knowledge of these tax laws, you could inadvertently reduce your overall wealth by incurring higher taxes.

Our consultations focus heavily on distributions, Roth conversion strategies, and ways to minimize tax, as well as address correct account allocations, risk levels in those accounts, and why. After your consultation, you’ll walk away with a solid financial plan and recommendations that will help you pursue your specific financial goals.

Have questions? Schedule a consultation with one of our team members today! Click here for contact information.

What are others saying about Storen Financial? Click here to read testimonials.

Signs It’s Time to Change Financial Advisors

There are many reasons that could prompt you to change advisors. Here are 4 reasons that should prompt you to reevaluate your relationship…

Tips for Choosing a Financial Advisor

Finding the right financial advisor is a crucial decision, but these tips should help you discover an arrangement that works best for you.

Risks of Using Multiple Financial Advisors

Unfortunately, advisor diversification doesn’t necessarily have the same benefits as portfolio diversification. Here are a few risks that come with using multiple advisors…

Wealth management

Financial Planning & Investment Services

Retirement Planning

Income Distribution

Investment Portfolios

Estate Planning

Roth IRA Conversions

Wealth Transfer Strategies

Family Wealth Management

Social Security Planning

Tax Planning & Preparation

Charitable Giving Strategies

Medicare Advising

Long Term Care Planning

Storen Financial has selected Charles Schwab & Co., Inc. as primary custodian for our clients’ accounts. Schwab Advisor Services serves independent investment advisory firms like ours and includes the custody, trading and support services of Charles Schwab & Co., Inc.

Traditional IRA account owners have considerations to make before performing a Roth IRA conversion. These primarily include income tax consequences on the converted amount in the year of conversion, withdrawal limitations from a Roth IRA, and income limitations for future contributions to a Roth IRA. In addition, if you are required to take a required minimum distribution (RMD) in the year you convert, you must do so before converting to a Roth IRA.

options for everyone

Choose the path that fits your specifc needs.

Meet the

Investment Team

Partnership with our Team

Our dedicated team works in partnership with you to help ensure you stay on a healthy financial path via sound financial planning, time-tested processes and clear communication. We’re committed to providing you…

- Honesty and transparency.

- A partnership to help achieve your identified goals.

- Guidance through complex Tax and IRA rules.

- Relevant continuing education and coaching.

- Ongoing portfolio analysis and rebalancing strategies.

Our simple step-by-step advisory relationship process makes it easy to get started.

Our team of experienced professionals work with you to develop a comprehensive, long-term financial plan that implements customized tax-saving strategies to fit your unique situation. Our simple step-by-step advisory relationship process makes it easy to get started… Click here for details.

Processes and strategies

What’s the difference between Storen Financial and your average advisor?

Annual Review

Imperative to the overall success of your investment planning strategy is an annual review. During your review, we will set and review goals, update your balance sheet, confirm beneficiaries, discuss any life events and create strategies in pursuit of your financial success.

Bucket Approach

The Now, Soon, Later Approach is an asset allocation strategy that guides our advisors in determining how we invest our clients’ assets. The end result is a Now Bucket with liquidity, a Soon Bucket with limited to no downside risk and a Later Bucket with growth potential.

Elite IRA Advisor Group

Greg Storen is a long-term member of Ed Slott’s (the nation’s leading IRA expert) Elite IRA Advisor Group, an exclusive organization dedicated to the ongoing study and mastery of constantly changing and complex tax laws impacting your retirement savings.

Dedicated Service Team

Our dedicated service team, who is always available to answer your call, provides you personalized and consistent attention. Working together, our team meets regularly to discuss investment strategies, portfolio direction, problem solve and continue our education.

Flat Fee-Based Approach

Our fees are transparent and explained upfront. There are no additional fees for your annual review, account maintenance or tax strategy. This approach allows us to determine risk tolerance, complete income gap analysis, and work with a broad range of investment vehicles to help accomplish your individual goals.

Fiduciary, in Advisory Relationships

By consulting with an advisor holding himself to a fiduciary standard, you can feel confident knowing that your best interest is at the heart of everything we do. We act on behalf of our clients, putting their interest ahead of our own, and upholding a duty to preserve good faith and trust.

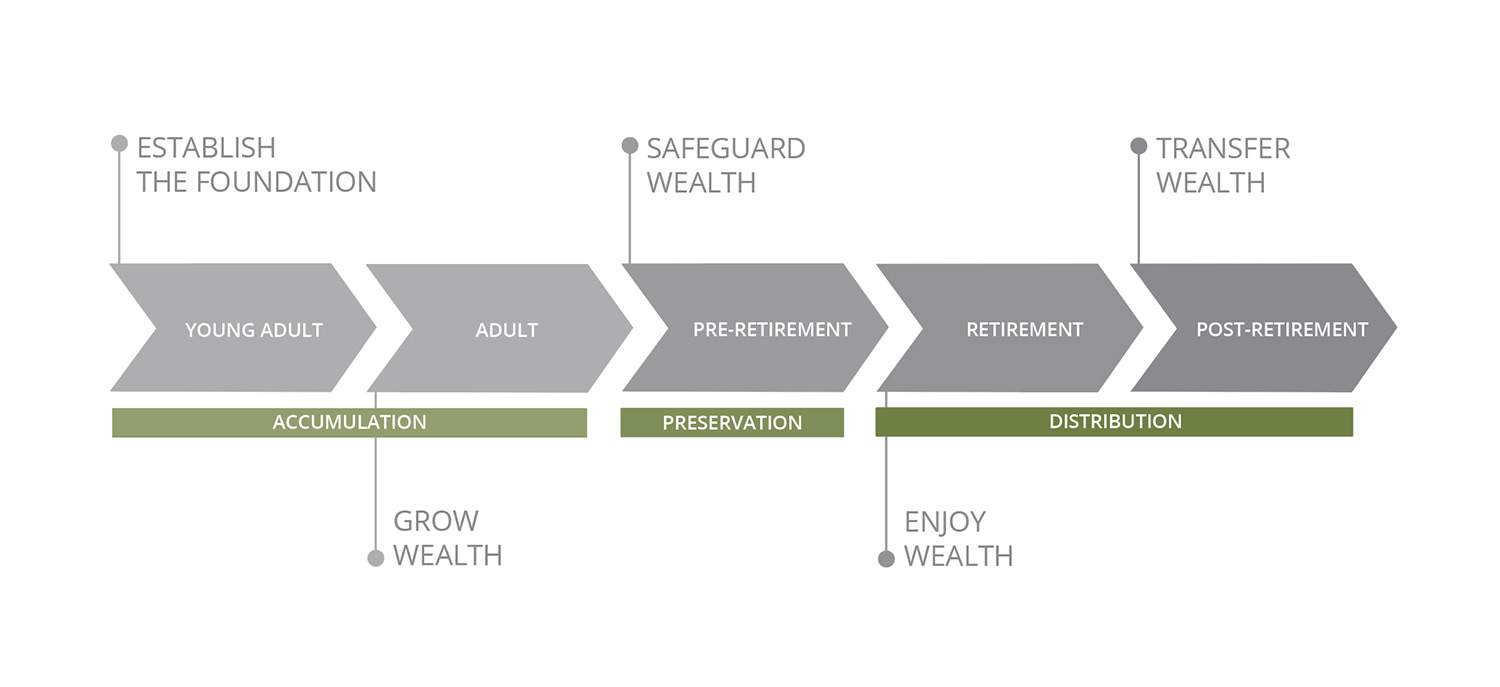

Resources to help no matter where you are along your financial journey.

This resource provides financial recommendations through various stages of life, for young adults through post-retirement. Click here to access this guide.

How can we help?

At Storen Financial, we offer so much more than tax preparation and accounting services. We go beyond the numbers to provide our clients with financial planning, in-depth consulting, and year-round support. Looking for more info? Click below to learn more.

LEARN MORE

Read the latest news and resources on our blog

Key Aspects of the One Big Beautiful Bill Act

How will the One Big Beautiful Bill Act affect you? The One Big Beautiful Bill Act of 2025 brings a host of changes that will sweep US tax law, affecting deductions, credits, and savings accounts across the board. To help you sift through all the legislation and...

Create a Realistic Budget in 6 Easy Steps

Know How to Utilize A Budget That Prioritizes Your Goals Whether you started a new job and have a much larger income now or you’re lost in the mix of heavy expenses and have no clue what you’re spending (but you’re pretty sure it’s too much), we’ve all had the rude...

Story: Employee Experience with the Storen Financial Young Professionals Program

Storen Financial Employee Shares Her Experience With the Young Professionals Program As a working person in my twenties, I entered the Young Professionals Program at Storen Financial having limited to no knowledge of how to build financial security other than through...