*Blog updated 6/24/21.

If you have dependents on your tax return under the age of 18 – Please read!

Monthly prepayments from the IRS of the Child Tax Credit will begin July 15th.

In March of 2021, Congress passed the American Plan Rescue Act. This legislation could impact you monthly, beginning July 15th.

For six months only from July, 2021 to December, 2021, the IRS will automatically send a prepayment of the Child Tax Credit to taxpayers on a monthly basis unless you Opt Out:

1) If your child is age 0-5 on December 31, 2021 – the Child Tax credit will increase from the 2020 amount of $2000 to the new amount of $3600. You will receive $300 per month per child.

2) If your child is age 6-17 on December 31, 2021 – the child Tax credit will increase from the 2020 amount of $2000 to the new amount of $3000. You will receive $250 per month per child.

*Updated 6/23/21:

Click here for information from the IRS about Advance Child Tax Credit Payments in 2021.

Click here for additional information and pdf printable resource.

If you have any trouble using the IRS online resources, please contact the IRS directly and they will be able to assist you.

Important Notes!

1) The tax credit is estimated on your most recently filed tax return (2020 or 2019) but it is truly based on the 2021 tax return. If you have any changes to your 2021 tax return you could potentially be required to pay the money back. For example, if you claim a child on your 2020 return, then receive the prepayment of the child tax credit but you do not claim the child on your 2021 – you will pay the credit back on your return. This is particularly impactful to divorced families that alternate years with dependents.

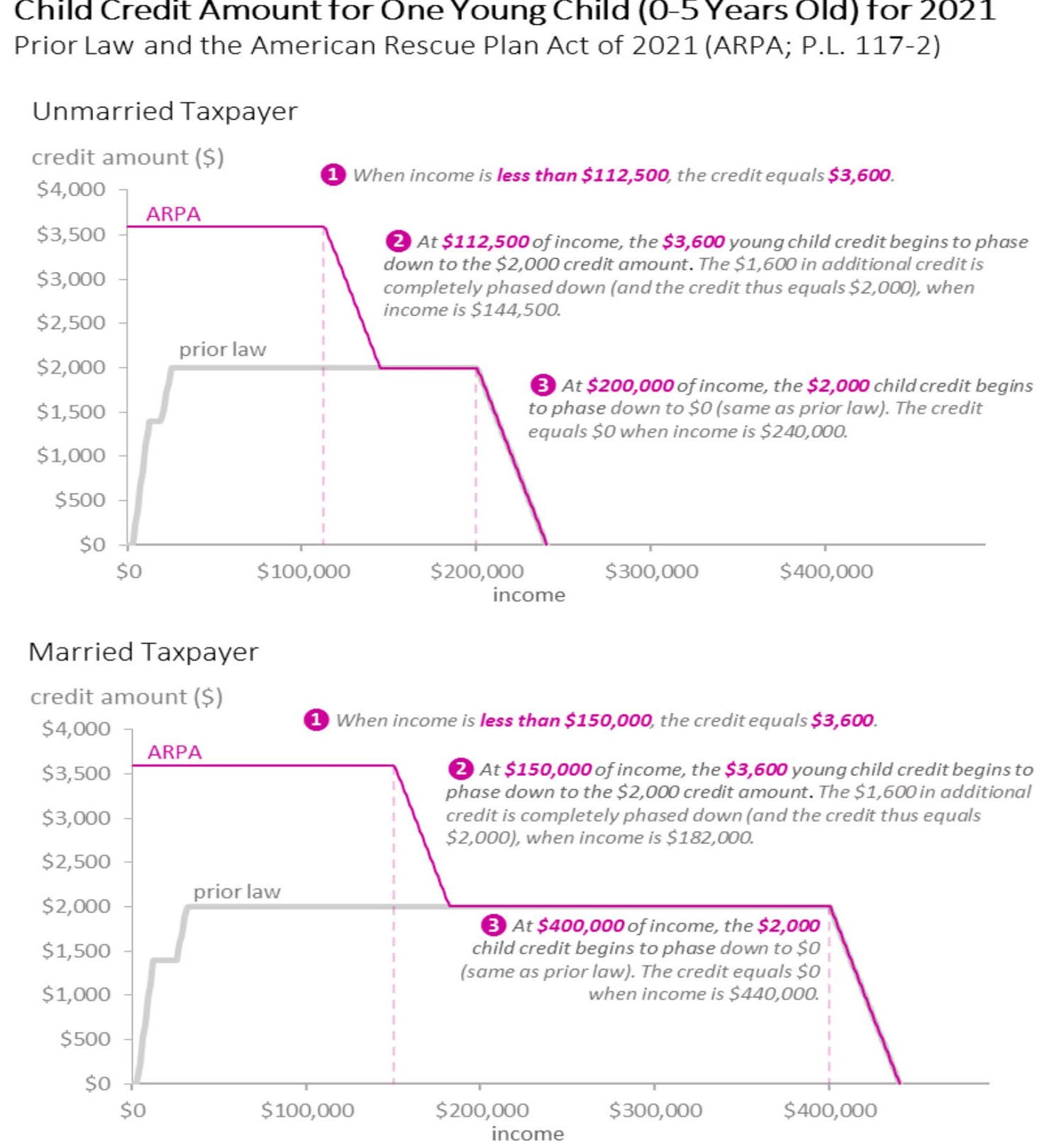

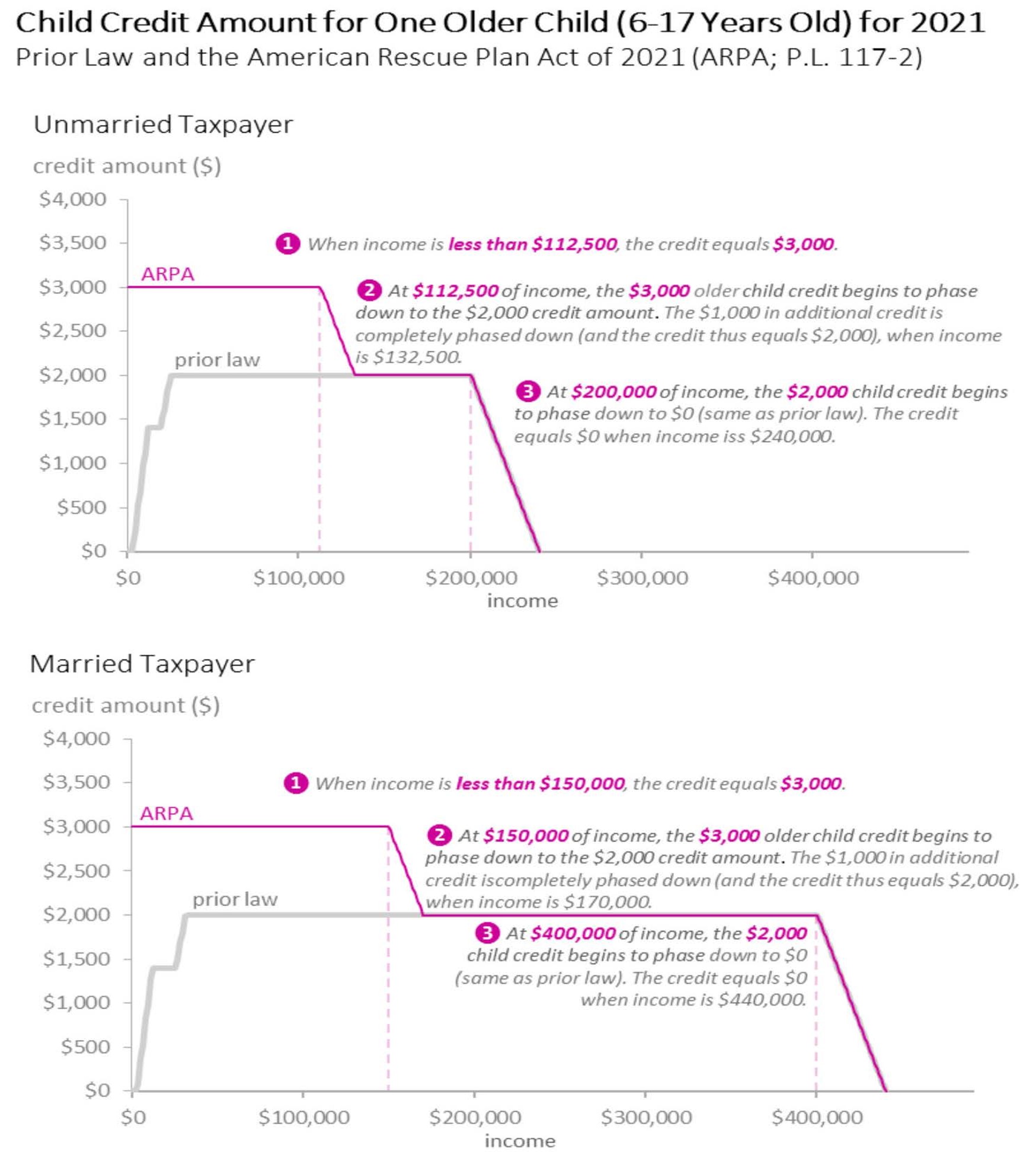

2) The child tax credit is subject to income phaseouts.

3) The IRS is opening a portal on July 1st for you to Opt Out of the prepayment. You will also be able to go into the portal to adjust your income, add or remove a dependent, and to add a newborn child.

4) Enjoy the extra money each month but don’t get too comfortable with it as payments end December 15th of 2021.

5) The 2021 Legislation added 17 year olds to the larger Child Tax Credit. In the past, Child Tax Credit was reduced in the year a child turned 17.

6) *Updated 6/22/21: If you do not normally file a tax return, you can sign up for the Child Tax Credit using the Child Tax Credit Non-filer Sign-up Tool (click here to learn more). This resource explains who should use this tool, how it works and what you need.

Should you Opt Out of the Monthly Payment (Unenroll)?

1) You will want to opt out if the dependent was claimed on your most recently filed return but will not be claimed on your 2021 return.

2) You will want to opt out if you expect your income to increase above the phaseout limits in 2021.

3) You will want to opt out if you normally owe money on your tax return. If you receive a prepayment of the tax credit you will owe MORE since the child tax credit was decreasing the amount you owed.

*Updated 6/24/21: To unenroll, login to your IRS Online Account and follow the Child Tax Credit unenrollment prompts. Click here to login to your account. Don’t have an account? Click here for instructions on how to create an account. Please note: If you are married filing jointly, your spouse will also need to unenroll. Click here for more FAQs about unenrolling.

More information about this credit from Taxspeaker.com

The following is an excerpt from Taxspeaker.com with a detailed in-depth look at the credit. (Link to source)

Summary of old (2020) rules for the child credit

2020 individual tax returns qualified for a child credit of $2,000 for children under age 17 on the last day of the year with a social security number claimed as a dependent on the return. Up to $1,400 was refundable. The credit began phasing out at $400,000 of AGI for joint returns and $200,000 for other returns. Key points of old law:

- Permanent part of law

- Under age 17 on last day of year

- Must be a dependent with a social security number by the due date of the return

- $2,000 credit per dependent

- $1,400 refundable credit per dependent

- Credit obtained when filing return for the year

Summary of new (2021 ONLY) rules for the child credit

2021 individual tax returns qualify for a child credit of $3,000 ($3,600 if under 6 at 12/31/2021) for children under age 18 on the last day of the year with a social security number claimed as a dependent on the return. The full amount is refundable. The increased amounts begin phasing out at $150,000 on a joint return down to $2,000, which begins phasing out at the 2020 levels as before. $112,500 and $75,000 begin the higher amount phaseouts for heads of household and single returns respectively, also dropping to $2,000 and phasing out at the 2020 amounts. This means for 2021 there is a stairstep phaseout of none up until $150k (MFJ), then partial to a $2,000 safe harbor until $400k MFJ, and complete after that.

Additionally, ARPA requires the IRS to pay ½ of the credit in advance in 6 monthly payments beginning in July, 2021 for individuals maintaining a principle residence in the United States for over ½ the year. This advance payment will be estimated based on 2020 returns (2019 if not yet filed) and then reconciled upon filing the 2021 return. The IRS will have a primary portal open by 7/1/21 where taxpayers can elect out of advance payments or update their 2021 income, filing status or qualifying children. Key points of new law:

- One year only (2021) change under current law

- Under age 18 on last day of year

- Must be a dependent with a social security number by the due date of the return

- $3,000 per dependent

- $3,600 if dependent is under age 6 at 12/31/2021

- Fully refundable

- 50% of credit paid in 6 payments in advance beginning 7/15/2021

- Remainder refundable with 2021 return when filed

The advance credit will then be reconciled when filing the 2021 return. Any additional credits due will be refunded with the return. The advance payments are to be electronically paid using the same mechanism used to send the stimulus checks. The portals can also be used to add new babies or dependents which would increase the 2021 credit.

Any excess payments are taxable with the 2021 return (Act Sec. 7527A(j)(2)(A))

A secondary portal will be open within the month for taxpayers that did not file a 2019 or 2020 return. See the Rev. Proc.above.

Older dependents will still qualify for the old $500 credit, but it will not qualify for the advance payment program. Unlike the stimulus check where divorced parents might have qualified for a dependent credit, the child credit will only apply to whomever claims the child on the 2021 tax return.

If you have any questions on how this will affect your return, please call our office anytime! Click here for contact info.

Blog by Kim Storen, EA – Tax Team Lead, Senior Tax Professional

Learn more about Kim and the rest of the Storen Financial team here.