News & Resources

Have questions? Looking for helpful resources and links? We’ve put together these resources to help you get answers to your questions. Need more information, give us a call! Also, don’t forget to check out our blog for the latest information.

RESOURCES

Resources to help you on your financial journey

Below are the resources we’ve assembled to help you on your financial journey. Click these buttons to quickly find the information you’re looking for and please don’t hesitate to give us a call if you have any questions.

Resources to help no matter where you are along your financial journey.

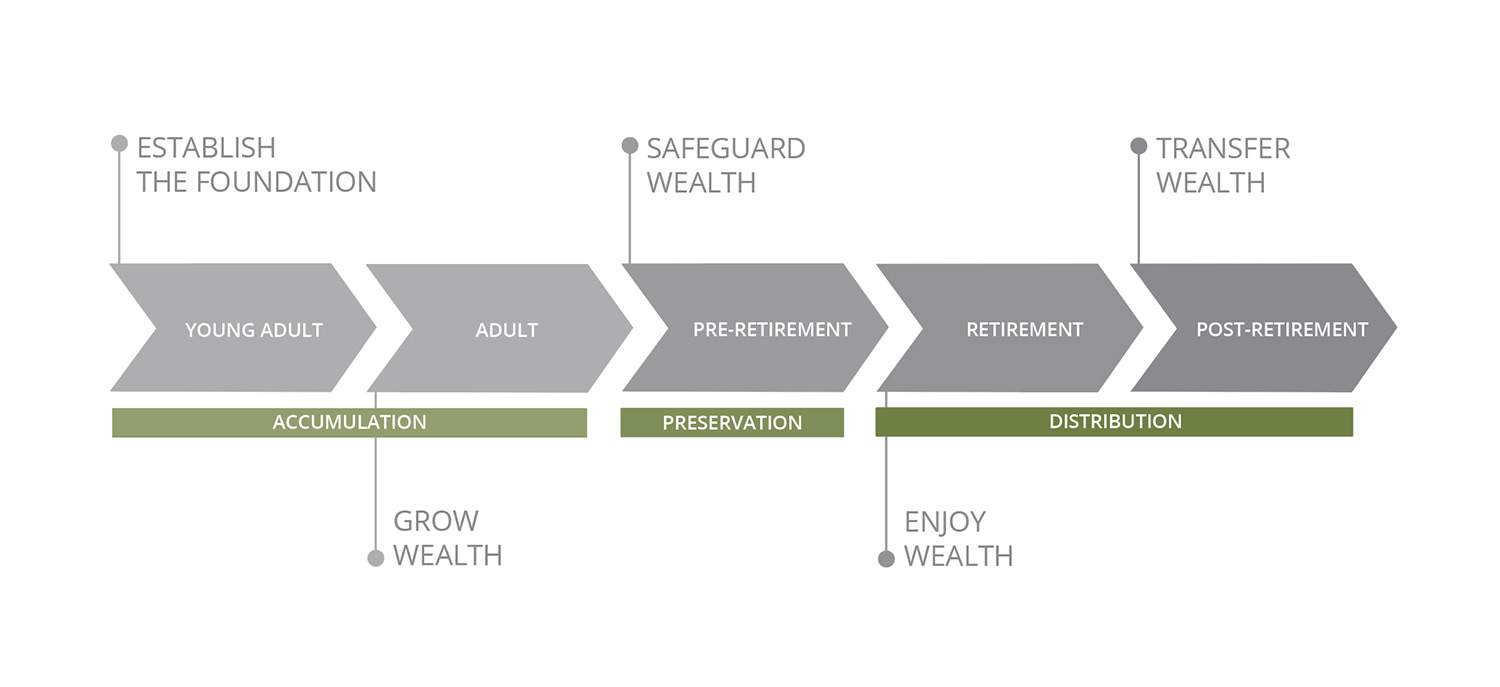

This resource provides financial recommendations through various stages of life, for young adults through post-retirement. Click here to access this guide.

BLOGS BY CATEGORY

Search our news and educational database

Our goal is to share pertinent information with you through our blogs, resource links, social media posts and updates. On our blog you’ll find all the tools, resources, and information you need. Have questions? Give us a call!

How can we help?

At Storen Financial, we offer so much more than tax preparation and accounting services. We go beyond the numbers to provide our clients with financial planning, in-depth consulting, and year-round support. Looking for more info? Click below to learn more.

LEARN MORE

Read the latest news and resources on our blog

Storen Financial Partnership Makes Headlines

Storen Financial in the Press: Launch of Storen Legacy Partners Recently, Storen Financial announced a strategic alliance with Dynasty Financial Partners, a leading platform for independent wealth management firms, to establish our own Registered Investment Advisor...

How to Make Your Tax Payments – Balance Due and Estimated Payments

Below you will find instructions on how to make your Federal and Indiana state Balance Due payments online as well as how to make your Federal and Indiana Estimated Tax payments online. These instructions do not require an account to be set up. Please note that...

Meet the Team – Kaleb Renner

Kaleb Renner Business Accountant Kaleb joined the Business Services team at Storen Financial in December 2025. He holds a Bachelor’s degree in finance from the IU Kelley School of Business and brings with him over two years of hands-on accounting experience from Meyer...