Congratulations to Senior Tax Accountant, Doug Johnson!

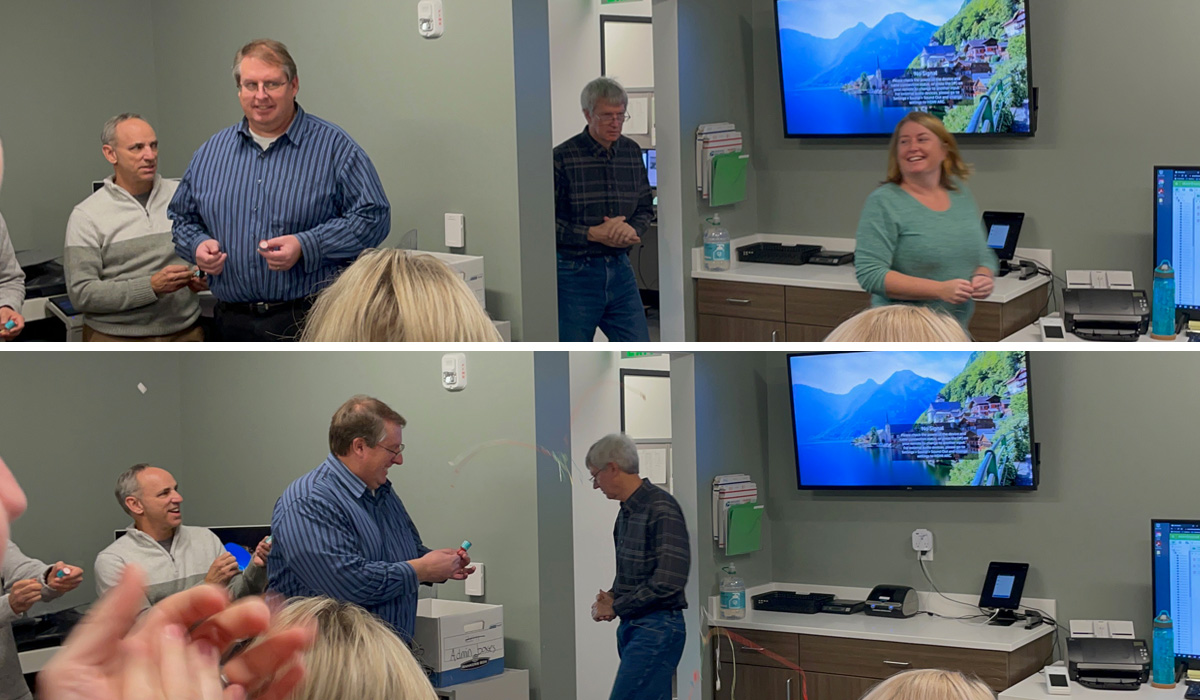

We’d like to take a moment to congratulate Doug on passing all 3 of the exams for the Enrolled Agent certification! We surprised Doug with confetti and cheers on his big achievement (pictured)! He can now add some very important letters next to his name. He still has a few more hoops to jump through with the IRS, but that’s nothing compared to the extremely difficult “Test 3 Basis” exam! Congrats again to Doug, we’re so happy to have his knowledge and expertise as a part of our tax services team.

What is an enrolled agent (EA)?

An enrolled agent is a person who has earned the privilege of representing taxpayers before the Internal Revenue Service by either passing a three-part comprehensive IRS test covering individual and business tax returns, or through experience as a former IRS employee. Enrolled agent status is the highest credential the IRS awards. Individuals who obtain this elite status must adhere to ethical standards and complete 72 hours of continuing education courses every three years. Click here to learn more.

Blog by Kim Storen, EA – Tax Services Director, Senior Tax Accountant

Learn more about Kim and the rest of the Storen Financial team here.