Understanding How Roth Conversions Can Impact Your RMDs and Save Tax Dollars

Oftentimes, new clients come to us after realizing they might be missing ways they can maximize their tax savings. One such situation recently occurred for a couple who came to us asking how they could reduce their tax liability and maximize their investments for retirement since they do not need an income stream after the age of 73. The answer? Consider a Roth conversion multi-year strategy.

What is an RMD?

An RMD is the minimum amount the IRS requires you to withdraw from qualified retirement accounts and IRAs beginning the year you turn 73 and each year after. The amount of each RMD is determined by dividing the combined total of all your retirement accounts as of December 31 of the prior year by your IRS life expectancy factor.

Which retirement accounts have RMDs?

Required minimum distributions apply to nearly all tax-advantaged retirement accounts— with the sole exception of Roth IRAs. You must take RMDs from these accounts:

- Traditional IRAs

- SEP IRAs

- SIMPLE IRAs

- 401(k), 403(b) and 457(b) plans

- Profit sharing plans

- Other defined contribution plans

This Roth conversion plan reduced the RMD total by over $285k.

Question: How do you reduce your tax liability and maximize your investments if you will not need an income stream after the age of 73?

Answer: Consider the Roth conversion multi-year strategy.

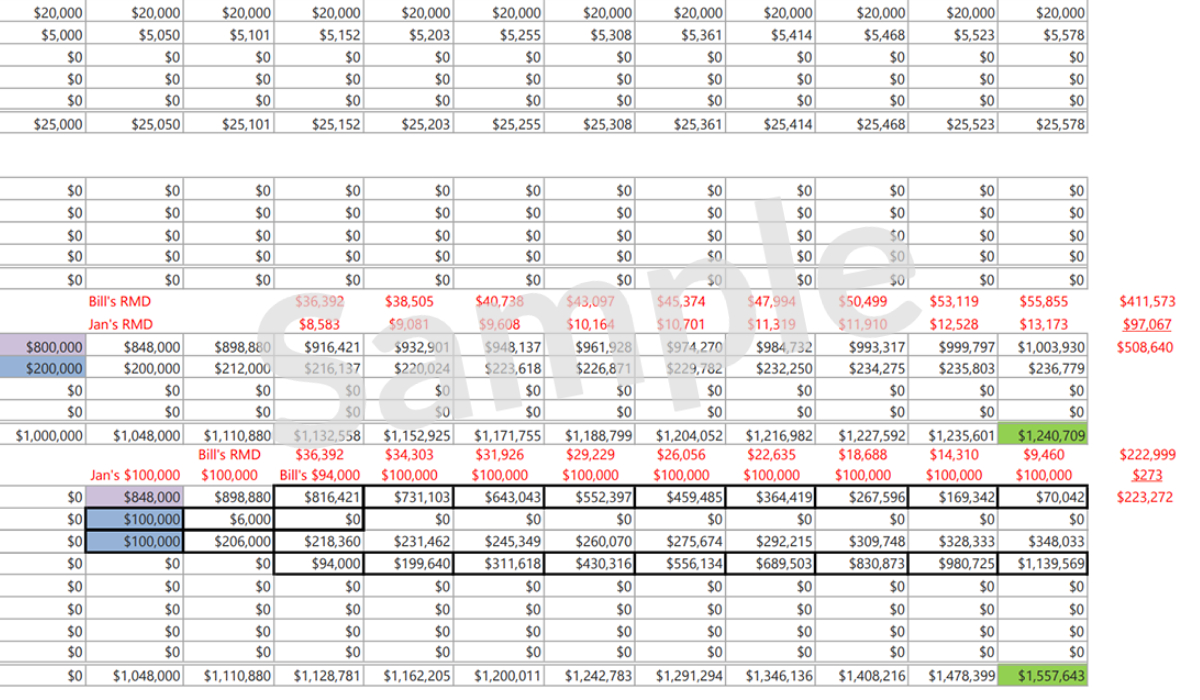

Using the Storen Financial multi-year balance sheet projection, we are able to see the power of the Roth conversion strategy by manipulating the fields to create different scenarios. In the above example (see picture) from one married couple’s balance sheet, we reduced the wife’s RMD to approximately $273, and then focused on drastically reducing the husband’s.

We limited the Roth conversions to $100k per year to prevent a large increase in their Medicare premiums by pushing them up into a higher premium tier. First, we calculated their RMDs each year (see in red) without any conversions and totaled them out to the right. In their first 10 years, they would be required to take an estimated $508,640 in combined RMDs. Next, we implemented our Roth conversion multi-year plan. As a result, only the husband would be subject to RMDs, and over the 10 years, the RMDs would be reduced to approximately $223,272… a difference of $285k!

Utilizing this plan will mean the couple has to pay taxes on the Roth conversions each year. If we assume an 18% tax rate, they will still save approximately $170k after taxes. It’s worth mentioning here that tax rates are estimated to be higher in the future. If they plan to pass these assets on to their children as inheritance, it is important to consider the tax impact from a multi-generational standpoint. Since Roth IRAs grow tax free, their children would not have to bare the burden of paying future (possibly higher) taxes on any of the converted amounts. This is a valuable benefit since it is estimated that these accounts will continue to grow over time (For example, paying less taxes now on a $500k balance is better than paying higher taxes later on a $1M balance), even if tax rates don’t go up.

Notice that by the end of the 10 year time span, they will have close to $1.5M protected from RMDs and future taxation! By contrast, without the Roth conversions, they would have approximately $1.24M subject to ongoing RMDs and future taxation.

Our Team of Financial Professionals at Storen Financial will work with you to create a comprehensive plan that will help you pursue your financial goals, from retirement planning to investments and IRAs. Learn more about our Financial Planning & Investment services here.

Or have questions? Want to schedule a consultation to discuss your tax-impacted financial strategy? Click here to contact us now.

Want to learn more?

Here are a few more resources to answer your RMD questions…

How You Can Reduce Your RMD – Ed Slott and Company

Retirement Plan and IRA Required Minimum Distributions FAQs – IRS

Required Minimum Distributions Retirement Strategies to Reduce Taxes – Forbes

4 Strategies to Limit Required Minimum Distributions (RMDs) – Investopedia

Blog by Matt Wilson – Portfolio Analyst Assistant

Learn more about Matt and the rest of the Storen Financial team here.

Traditional IRA account owners have considerations to make before performing a Roth IRA conversion. These primarily include income tax consequences on the converted amount in the year of conversion, withdrawal limitations from a Roth IRA, and income limitations for future contributions to a Roth IRA. In addition, if you are required to take a required minimum distribution (RMD) in the year you convert, you must do so before converting to a Roth IRA. The example used is for illustration purposes only. Your results may vary.

The information contained herein is hypothetical in nature and is for illustrative purposes only and does not reflect the experience or performance of any actual client. The scenarios presented are intended to demonstrate general concepts and should not be relied upon as an indication of future results or specific outcomes. Investing involves risk, including the potential loss of principal. Past performance is not indicative of future results.