What is NUA?

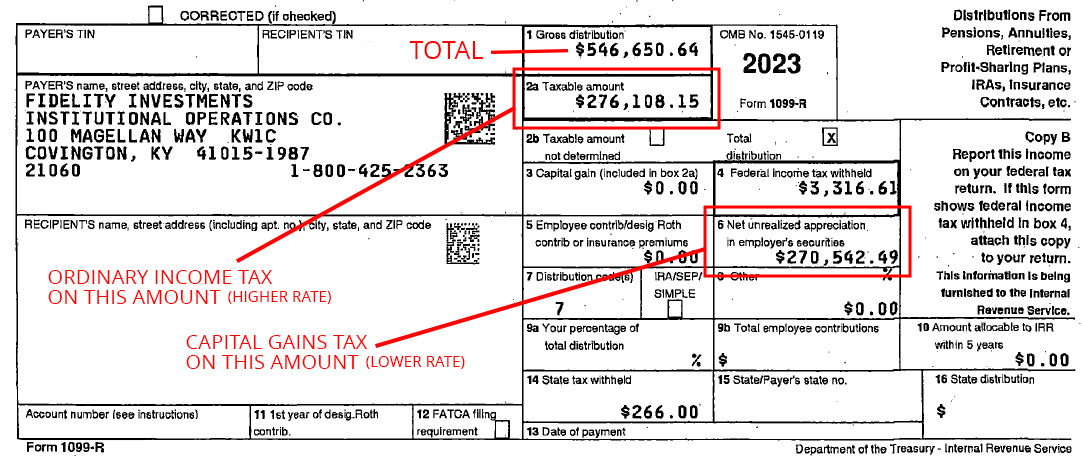

NUA (Net Unrealized Appreciation) is “the difference in value between the cost basis of company stock and its market value at the time it is distributed In Kind from a plan as part of a lump-sum distribution.” Typically, distributions from tax-deferred retirement accounts are treated as ordinary income at the time of distribution. Ordinary income is taxed at a higher rate than long-term capital gains. To remedy this issue, the Internal Revenue Service (IRS) offers an election for the NUA of employer stock to be taxed at the more favorable capital gains rate.

The NUA election is only available when the stock is placed into a tax-deferred account, such as a 401(k), and is only applicable to the stock of the company for which you are or were employed. Roth IRAs do not qualify for NUA because they are not tax-deferred, and brokerage accounts do not qualify for NUA because they are generally already subject to the capital gains tax. (Click here to learn more about NUA.)

Storen Financial Advisor Recognizes NUA as a Tax-Saving Option

Recently, a couple came to one of our advisors for advice on moving their Employee Stock Ownership Plan (ESOP) to a non-qualified joint account. Many people with ESOPs, especially those at successful companies, have a majority of their portfolio in one stock. That was the case for this couple, who wanted to reduce risk by diversifying their portfolio.

However, in order to minimize the tax owed on the ESOP, the advisor first verified whether a NUA transaction was available to them through the after-tax money inside of the ESOP. Our Storen Financial Advisor recognized that this strategy, though not well-known, would enable our clients to pay less ordinary income tax. Additionally, the couple would also pay less tax using capital gains rates in a non-qualified account rather than a Traditional IRA. Our advisor would also be able to liquidate some of the company stocks at the 0% federal tax rate. Overall, by putting the clients’ money into the long-term capital gains “basket” with the NUA, our advisor helped to ensure that the clients paid less tax in the long run. (See image below.)

Prior to coming to Storen, the couple had met with four other advisors who all missed this option. When you have an investment advisor who is not your tax accountant, you run the risk of potentially missing these key tax-saving opportunities. Click here to read about a few more advisor red flags.

At Storen Financial, our Financial Advisors regularly study complex tax laws and undergo rigorous training through Ed Slott’s Elite IRA Advisor Group. We want you to understand our tax-saving strategies for building and diversifying your portfolio. For that reason, we happily sit down with clients to answer your toughest questions and help you spot strategies you may have missed, with the goal to instill the confidence and knowledge you need to place your trust in our team and what we do.

Have questions? Or interested in meeting with our Storen Advisory team? Click here to contact us now. Or click here to learn more about our Financial Planning Investment Services.

*For illustration purpose only.

Blog by Greg Storen, MBA – President/CEO, Advisory Services Director

Learn more about Greg and the rest of the Storen Financial team here.

This is a hypothetical example and is not representative of any specific investment. Your results may vary

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

Contributions to a traditional IRA may be tax deductible in the contribution year, with current income tax due at withdrawal. Withdrawals prior to age 59 ½ may result in a 10% IRS penalty tax in addition to current income tax.