Create a Budget that Prioritizes Your Goals

Whether you started a new job and have a much larger income now or you’re lost in the mix of heavy expenses and have no clue what you’re spending (but you’re pretty sure it’s too much), we’ve all had the rude awakening of realizing we need a solid budget. Our Young Professionals Program will help you assemble this budget, align it with your long-term and short-term goals, and establish ways you can work toward them. Click here to continue learning about how to create a realistic budget.

Improve Your Budget by Calculating Your Net Worth

As you get better with your budgeting, you’ll find you have more money for investing and paying off debts. But just how much better are you getting with your budgeting?

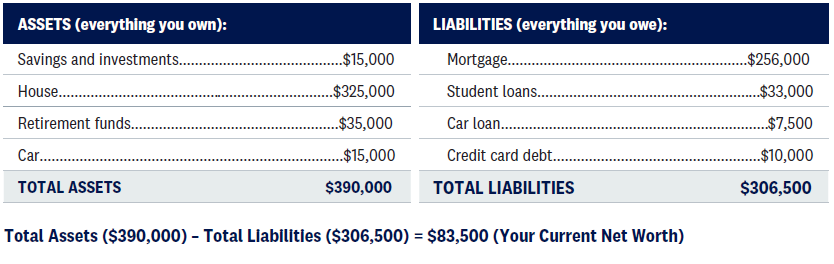

Calculating your net worth is a good way to gauge your current financial health and your progress over time. It is simply taking the value of what you currently own (your assets) and subtracting what you currently owe (your debts). Just think of it as a snapshot that shows where you are financially at a given point in time.

Here’s an example:

To help gauge the current value of your home, you can check out online resources such as Zillow, Redfin or Realtor.com. For your car, you can try Consumer Reports, Edmunds or Kelley Blue Book.

If you took a picture of your finances a year ago, today and a year in the future, you could probably see a trend. Assuming you are doing all the right things, your net worth should grow year by year. As you save and invest money, that money has the potential to grow (in a good year) and you continue to pay down your debts, including your home mortgage.

Your financial services professional can be very valuable in helping you calculate your net worth and offer advice on how to build it up over time. In addition, there are several online net worth calculators that you can access for free, on sites such as NerdWallet, Simple Dollar, or Kiplinger.

Learn more by reviewing these helpful resources

Need help calculating your net worth so you can build financial security as a Young Professional? Click here to contact us now.

At Storen Financial, we’ve created blogs, educational videos, and other resources designed specifically with you in mind. These resources include topics on how to invest, establish credit, decipher a retirement plan, and more. Get an early start by reviewing this information now! Click here to access all of our Young Professional resources. Or click here to learn more about our Financial Planning and Investment services.

Blog by Joseph Cavazos – Financial Assistant

Learn more about Joseph and the rest of the Storen Financial team here.

*This material was prepared by LPL Financial, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All investing includes risk including loss of principal.