Official Tax Season Launch for Storen Financial

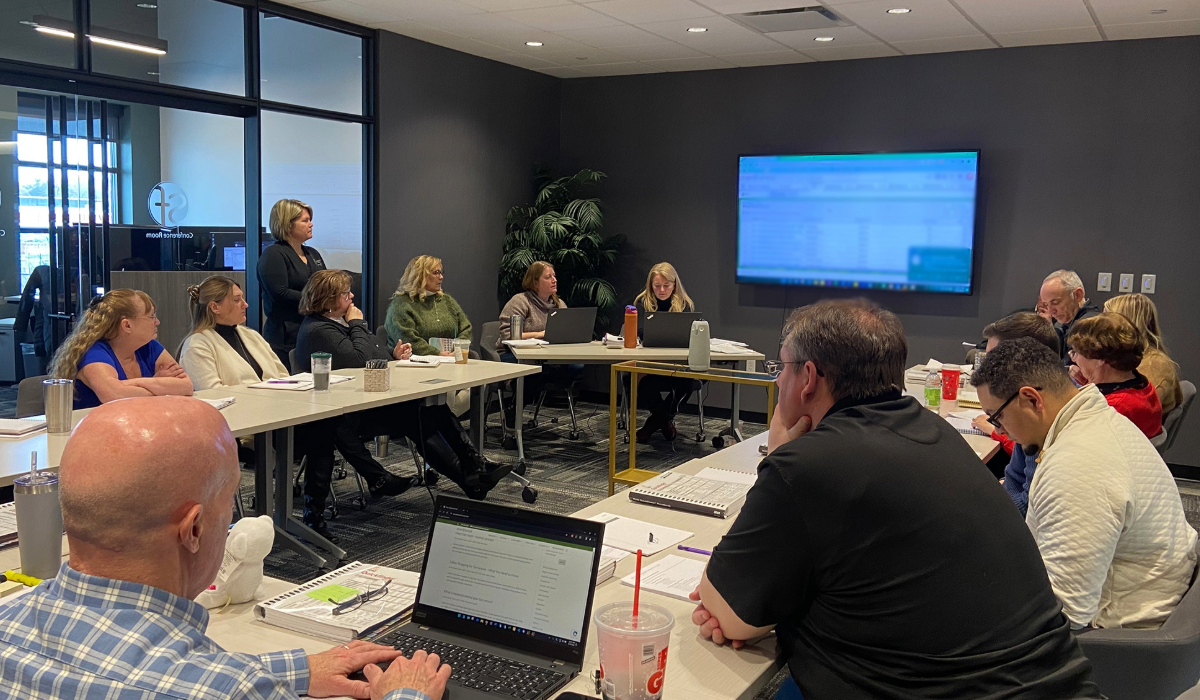

The Storen Financial team is launching into tax season. Kim Storen, our Tax Services Manager, recently led a two-day training session for our team of knowledgeable CPA’s, EA’s, MBA’s, Business Accountants, and Administrative Staff Members. The focus included a review of new tax law updates, improved processes, new forms and resources, and common questions that often affect our clients and their businesses. Our ultimate goal is to make tax season an exceptional experience for our clients and associates.

Hot topics from this training event included:

- Indiana tax law updates

- Multi-state K-1s

- Mileage rates

- Depreciating a vehicle vs. taking mileage

- Crypto income reporting and documentation

- New Energy Efficiency credits and changes

- Business Bonus Depreciation changes

- New Business Pass-Through Entity Tax

Our team remains diligent about staying up-to-date on the evolving tax laws and examining important tax-saving opportunities. We are committed to minimizing your tax liabilities and maximizing your future opportunities — while remaining in full compliance with IRS statutes.

Have questions about income tax preparation? Our newest video compiles all the resources you’ll need for tax season, including critical updates on law and regulation changes, important information about data security, event reminders, form links, and much more… Everything you need is here! Click here to watch this video.

Or click here to contact us with any questions you have.

Blog by Daniel Walters, EA – Senior Tax Accountant

Learn more about Daniel and the rest of the Storen Financial team here.