This Thing Called Life

As each new life event unfolds, we can expect our tax situation to change. Let’s take a look at a few milestones and address the impact they’ll have on your wallet. We’ll highlight the changes brought about with the passage of new legislation. Let’s get started!

- Your first job

- Employer health care options

- Getting married

- Having a baby

- Saving for college

- Buying or selling a home

- Losing a job

- Inheriting property

- Saving for retirement

- Estate planning

- Dealing with a death

Your first job

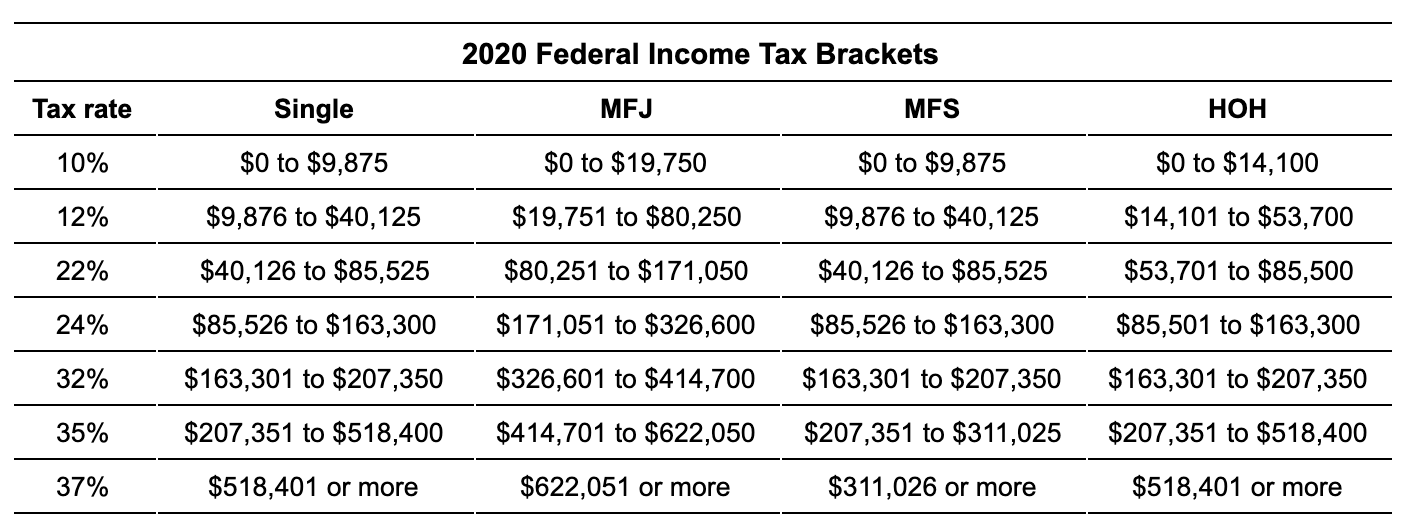

Congratulations! You’ve finished your education and are starting a new job. The first thing you’ll want to do is find your tax rate in the table below.

As you determine your tax bracket, you can fine-tune your withholding to ensure that you have the right amount withheld from your paycheck so that you don’t have a surprise at tax time. The new Form W-4 may be confusing; irs.gov provides tools to help. Search for “Withholding Estimator.” You can answer questions about your income to help you figure out your withholding. Alternatively, call me and we can work through the forms together.

If you work full time, you are likely to have benefits available to you. Take full advantage of employer-provided health insurance, retirement plans, or anything else they offer. Saving early in your career will leave you a nice nest egg when you retire.

Employer health care options

Now that you’re employed, there are a number of health care options that may come with your new job. These include:

• PPO. Preferred provider organizations used to be the norm for large employers. This is a plan with a lower deductible. Providers contract with the insurance company to deliver care at a discounted price. Generally, the employer pays part of the premium as a benefit.

• HMO. Health maintenance organizations are similar to PPOs, although with slightly lower premiums, generally. However, this comes at a price. There are more restrictions on providers who are in the provider network.

• HDHP/HSA. High deductible health plans and health savings accounts have become more and more common in the last several years. As the name implies, HDHPs have significantly higher deductibles. In exchange for that, the plan provides certain wellness maintenance items for free and provides a maximum out-of-pocket amount for participants. In addition, participants can contribute pre-tax dollars to a health savings account, which, if used for medical expenses, is tax free. Employers often match contributions up to a certain amount. In addition, taxpayers can get a deduction for after-tax contributions to the plans. There is an upper limit to how much a taxpayer can contribute. For 2020, it’s $3,550 for an individual and $7,100 for a family.

• HRA. Health reimbursement accounts may be offered in lieu of traditional employer-sponsored plans. These allow employers to create a fund from which they can reimburse employees who have medical expenses. Generally, these distributions are tax free. New types of HRAs in 2020 allow for reimbursement for marketplace insurance premiums.

• Marketplace insurance. Marketplace insurance is used primarily by individuals who do not have the option of an employer-provided health insurance plan. The marketplace allows the taxpayer to choose from several plans at varying prices and levels of coverage.

Some employers offer a variety of plans. Compare and choose the right one for your situation. To better understand the tax impact on your personal situation, give me a call to discuss your mid-year health insurance change and the best strategy for you.

Getting married

Congratulations on your nuptials! What does this mean for your taxes? First, it means you have two new filing statuses available to you. These are married filing joint (MFJ) or married filing separately (MFS). If you are married before midnight on December 31, you are considered married for the entire year.

So, what’s the difference between MFJ and MFS? With the MFJ filing status, all income from both spouses are reported on the same return, and all deductions and credits are shared. Along with this, the spouses are jointly and severally liable for the entire tax bill, meaning the IRS can pursue either spouse for the entire balance due.

With the MFS filing status, spouses separate their income, deductions and liabilities. If one spouse does not pay their tax, the other spouse is not responsible for paying it. However, this separate liability comes at a cost. Many deductions and credits are reduced or eliminated for taxpayers who file MFS. In addition, both spouses must either take the standard deduction or itemize.

Having a baby

Having a baby changes your life in every way. One of those ways is taxes. There are a variety of tax benefits related to having children.

The Child Tax Credit provides up to $2,000 of credit for each child under age 17. This benefit is available to all but the highest income taxpayers. The credit begins to phase out when income exceeds $200,000 for all filers except MFJ, for whom the credit begins to phase out at $400,000 in income. A portion of this credit can be refundable.

If you incur childcare expenses to enable you to work, you may be able to take the credit for child and dependent care. The credit is equal to up to 35% of the first $3,000 in childcare expenses for one child. For more than one child, the amount increases to $6,000. This credit is not refundable, so it can only reduce your taxes to zero. Related to this, an employer can provide up to $5,000 in dependent care benefits without the benefits being included in income. However, the same expenses cannot be used for both the credit and employer benefits.

The earned income tax credit (EITC) is available to certain taxpayers who do not have children, but the biggest benefits are reserved for taxpayers with children. The EITC ranges from $538 to $6,660 for 2020, based on the filing status, income, and number of children. The EITC is a refundable credit.

If you built your family through adoption, you may be able to take a credit for some of your expenses. In 2020, up to $14,300 is allowed for each child. If the adoption is not finalized, you can take the credit in the year after the expenses are incurred. If the adoption is finalized, then expenses can be taken in the year finalized. For foreign adoptions, expenses can only be taken in the year the adoption is finalized. Using the rules of your state, if the adoption is determined to be a special needs adoption, you can take the entire credit even if you did not incur $14,300 in expenses.

New legislation: To assist with adoption or the birth of a child, the SECURE Act, signed in December 2019, adds an additional exception to the penalties for taking an early distribution from a retirement account. If the distribution is used for a qualified birth or adoption, there is no penalty. A distribution for qualified birth or adoption is for expenses incurred within one year of the birth or adoption of a child. The distribution is limited to $5,000 per individual. So, if you’re married, each spouse can take $5,000.

If you are not married, or are considered unmarried, you may file as head of household (HOH). This provides a higher standard deduction and increased thresholds on several credits and deductions. In order to qualify as head of household, you must be unmarried or considered unmarried, have a qualifying person living with you and pay more than half of the upkeep of the home.

Saving for college

Parents and relatives who choose to set aside money for a child’s education have several options.

A 529 plan, or Qualified Tuition Plan, is a plan that allows you to save for the education of your children or grandchildren. These can be used for anything from kindergarten through graduate school. There are two general types of 529 plans— savings plans, where you set aside money that grows tax free (assuming the money is paid for education expenses), and prepaid tuition, which locks in a price with a particular institution. These plans are administered by the states. Check with your state to see your options. The Coverdell ESA is a similar way to save for education, although the contribution limit is $2,000 per year for each beneficiary.

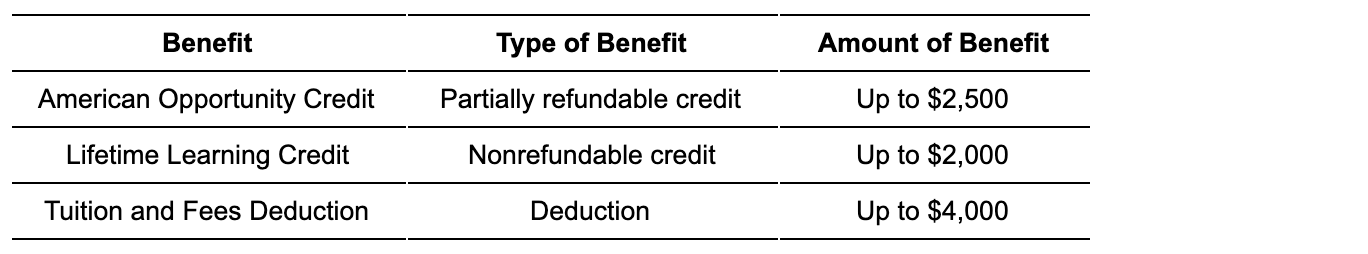

In addition to saving for college, there are three ways to take a deduction or credit for education expenses. The chart below shows the differences.

Each of these credits has income limitations. See me for more information on the requirements and to determine which benefit is right for you. New legislation: The tuition and fees deduction was extended through the 2019 extenders legislation. It’s retroactive to 2018, so you may wish to check if taking the deduction rather than a credit provides a better result.

Buying or selling a home

Congratulations on buying a new house! With it comes a lot of responsibility. But also, some tax benefits! Interest that you pay on your mortgage can be deductible, as can the real estate tax on the property, and if you pay it, private mortgage insurance. With the higher standard deduction, fewer taxpayers itemize, but I can help you maximize your tax benefits of owning a home.

The price that you paid for your house is your basis in the house. Certain home improvements may increase your basis. This becomes important when you sell your house. Track any expenses you incur for remodeling, landscaping, plumbing, heating/cooling, and window, siding and roof replacement to name a few.

If you have any questions about whether an improvement to your house adds to your basis, please give me a call.

If you’re selling your house at a profit, there are also tax benefits for you at the sale of your home. You can exclude up to $500,000 in gain on the sale of your home if you’re married. If you aren’t married, you can exclude up to $250,000. In order to exclude the gain, you must have owned your house at least two of the last five years, and you must have lived in your house for at least two of the last five years. These two do not need to be the same two years, although generally, they are. This gain exclusion can only be taken once every two years.

Losing a job

What if the worst happens and you lose your job? There are some options you have to get through this rough time.

Unemployment. First, if you have been laid off, you can file for unemployment. This income is taxable, just as any other income. New legislation: For unemployment between Jan. 27, 2020, and Dec. 31, 2020, a covered individual (one who cannot work or is laid off because of the coronavirus pandemic) can receive up to 39 weeks of unemployment pay. The amount of unemployment pay is the state amount, plus $600 per week from the federal government. This includes part-time employees and those who are self-employed.

Government benefits. Governmental welfare benefits are not taxable. This includes the Low Income Home Energy Assistance Program (LIHEAP), Medicaid, Supplemental Nutrition Assistance Program (SNAP, also called food stamps), Temporary Assistance for Needy Families (TANF), and Women, Infants and Children (WIC).

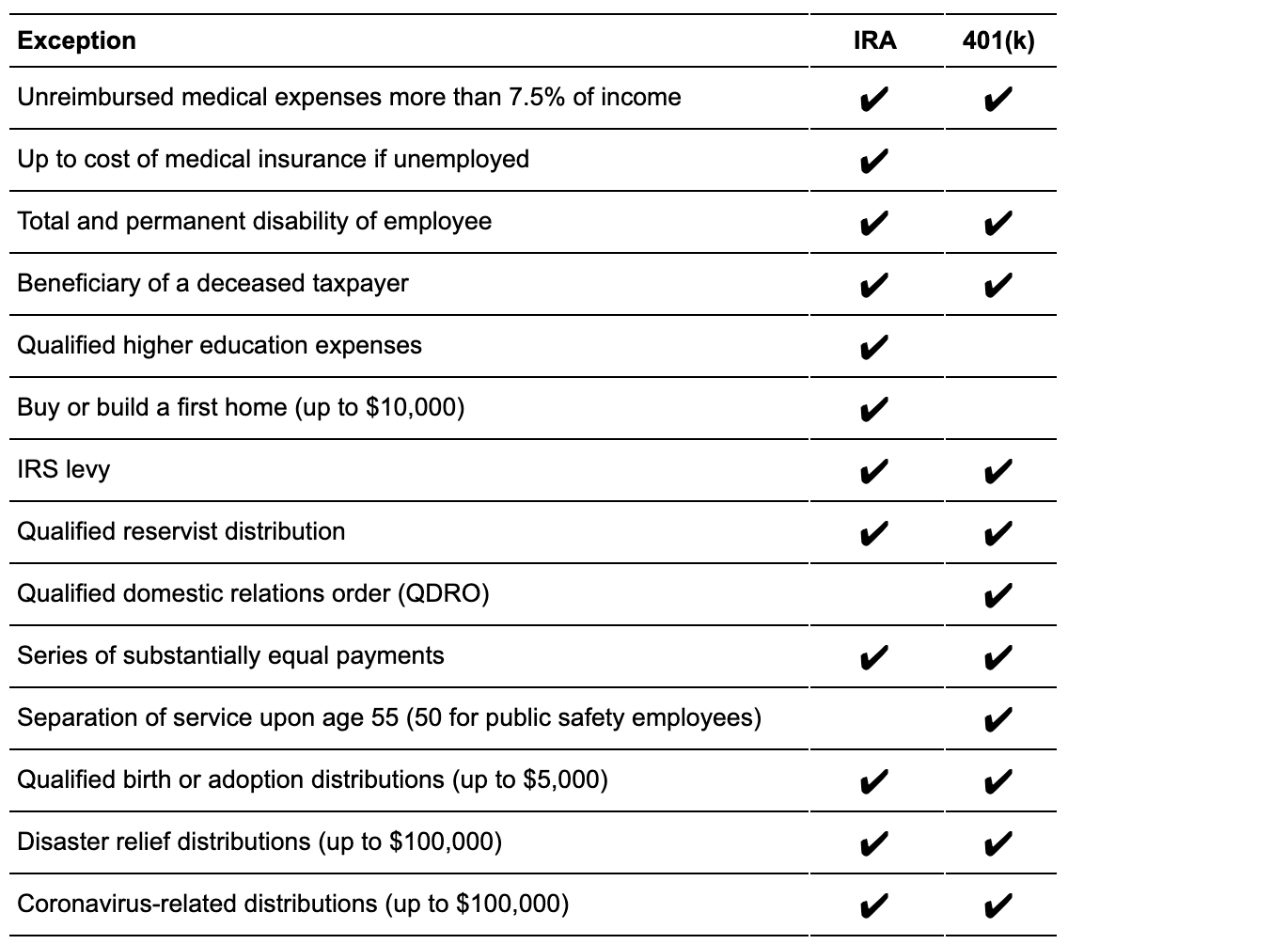

Distributions from qualified plans. This should be considered as a last resort. Distributions from a retirement plan are generally includable in income. And for many people, they are subject to a 10% early distribution penalty as well. See the chart below for exceptions to the penalty provisions. New legislation: Qualified birth or adoption distributions and disaster relief distributions are covered by the SECURE Act. Coronavirus-related distributions are covered by the CARES Act.

Inheriting property

At some point in your life, you’ll probably inherit property. Knowing the tax effect of these inheritances can help you navigate the process. First of all, inheritances and gifts are not included in income. Certain income-generating items you inherit may result in taxable income as income is distributed.

In addition, property received from a decedent receives what is called a step-up basis. This means your basis is equal to the value of the property as of the date of death. For example, you receive the home of your deceased grandfather. He bought it for $35,000 in 1960, and it is worth $300,000 in 2020. You sell it for $300,000. Without a step-up in basis, you would have a gain of $265,000. Instead, you have no gain.

You may also inherit an IRA. This is a more complex transaction. The treatment depends on the beneficiary designation and the relationship between the beneficiary and the deceased person.

New legislation: In prior years, distributions to beneficiaries of an IRA owned by a deceased person could be distributed over the lifetime of the beneficiary, but the 2019 SECURE Act limited it to ten years. However, if a spouse is named as the beneficiary of an IRA, the spouse can treat it as their own, meaning they can take distributions based on their lifetime, roll it over into another IRA they own, or treat it as if they are the beneficiary.

If an individual other than the spouse is named as beneficiary, the options are more limited. If you are less than ten years younger than the deceased owner, a minor child of the deceased person, or disabled, you can take the distributions over your lifetime. New legislation: In all other cases, the beneficiary must take the distribution over ten years due to the 2019 SECURE Act change.

Listing the estate as the beneficiary should be avoided if at all possible. The estate is not considered a designated beneficiary, and the distributions are made over five years instead of ten years. If you find yourself in this situation, I can help you find out if there’s a way to mitigate the effects. Here’s an opportunity for you to help others by reminding them to verify that they have a beneficiary listed on their IRA and retirement accounts.

Saving for retirement

You have many ways to save for retirement using tax-favored accounts. Three of the most common are a traditional IRA, a Roth IRA, and a 401(k)-type qualified plan.

A traditional IRA is an account that holds assets for retirement. If you contribute to an IRA, you may be able to take a deduction for your contribution. You can only contribute a total of $6,000 in 2020 to an IRA (whether traditional or Roth), with an additional $1,000 if you’re age 50 or older. These amounts can be different if you participate in a qualified plan at work. A traditional IRA gives you a tax deduction now, but taxable income later.

A Roth IRA is similar in some ways to a traditional IRA. It will hold your money until you need it for retirement. However, unlike the traditional IRA, the contributions are not deductible. On the other hand, the qualified distributions are not taxable. So, it is the inverse of the traditional IRA—no deduction now, but no taxable income later.

A 401(k) plan is a benefit that your employer can provide. Contributions are generally made pre-tax through payroll deferrals, and often the employer matches a portion of the contribution. The employer may offer a designated Roth 401(k) component that acts in a similar manner to a Roth IRA by allowing after-tax payroll deferrals. You can contribute up to $19,500 in 2020 (whether pre-tax or designated Roth).

If you have questions about how much you can contribute and whether to use pre-tax or after-tax, call me so we can discuss your options.

Estate planning

As you are planning your estate, you should be thinking about more than just who gets your property. Certain documents, such as a power of attorney and living will, should be created as soon as you are old enough to vote. Let’s look at each one.

A power of attorney is a document that designates who can make decisions for you if you are unable to make them yourself. If you don’t have one, you should create this document now. There are two different types of power of attorney: one for financial decisions and one for medical decisions. You may not wish to have the same person making decisions for both.

A living will is an expression of your wishes about your health care. If you are not able to discuss your care with medical personnel, this document lays out your wishes. It’s important that you share this document or your wishes with your power of attorney for health care, as they will be empowered to make decisions on your behalf if you are incapacitated. If you do not have a living will now, you should create one.

A will directs an executor to distribute your property to the people or entities you wish to receive your property after you die. In addition, this document determines who will be named as guardian of your children. This document usually is drafted by an attorney and must be signed with certain formalities based on your state law. Upon death, a will generally must be admitted to probate, and distribution of property is available only with court permission. This process can take up to six months and generally requires the assistance of an attorney. If you do not have a will, your property will be distributed according to state law, which may not be in line with your wishes.

A revocable trust serves the same purpose as the will. However, a trust avoids probate for property that is transferred to the trust. This document is created by an attorney. It is vitally important that you transfer all property, otherwise the property will have to pass through probate first.

Whether to choose a will or trust is an important decision. A trust costs more up front but saves money later. A will is less expensive to set up, but costs time and money at your death. Generally, the older you are and the larger your estate, the more likely you should use a trust.

Dealing with a death

When a person dies, there are a number of tax documents that may have to be filed. It is the responsibility of the personal representative to file these documents. This may be the trustee, executor, spouse or anyone else who has control of the property.

The personal representative must file a final Form 1040 for the deceased person. If the deceased person was married, the surviving spouse can file as married filing joint. If the deceased person was single, a final Form 1040 with a short year, ending on the date they died, is filed.

The rest of the year is reported on Form 1041, which is the income tax return for estates and trusts. During the probate of the deceased person or the administration of their trust, the executor or trustee must file this income tax return.

If the deceased person was married, or if their estate is over $11,580,000 for 2020, a Form 706 may need to be filed. This complex estate tax return reports all of the assets owned by the deceased person at the time of their death. If the assets are in excess of $11,580,000, they may have an estate tax. Come and see me if you ever need to complete a Form 706.

Blog by Kim Storen, EA – Managing Tax Accountant, Business Services Manager

Learn more about Kim and the rest of the Storen Financial team here.