What is the pass-through entity tax?

“Gov. Eric Holcomb signed Senate Enrolled Act 2 into law Feb. 22, 2023, authorizing certain pass-through entities to voluntarily elect to pay tax at the entity level based on each owner’s total share of adjusted gross income. It is retroactively effective for taxable years beginning on or after Jan. 1, 2022.”

How to make a payment:

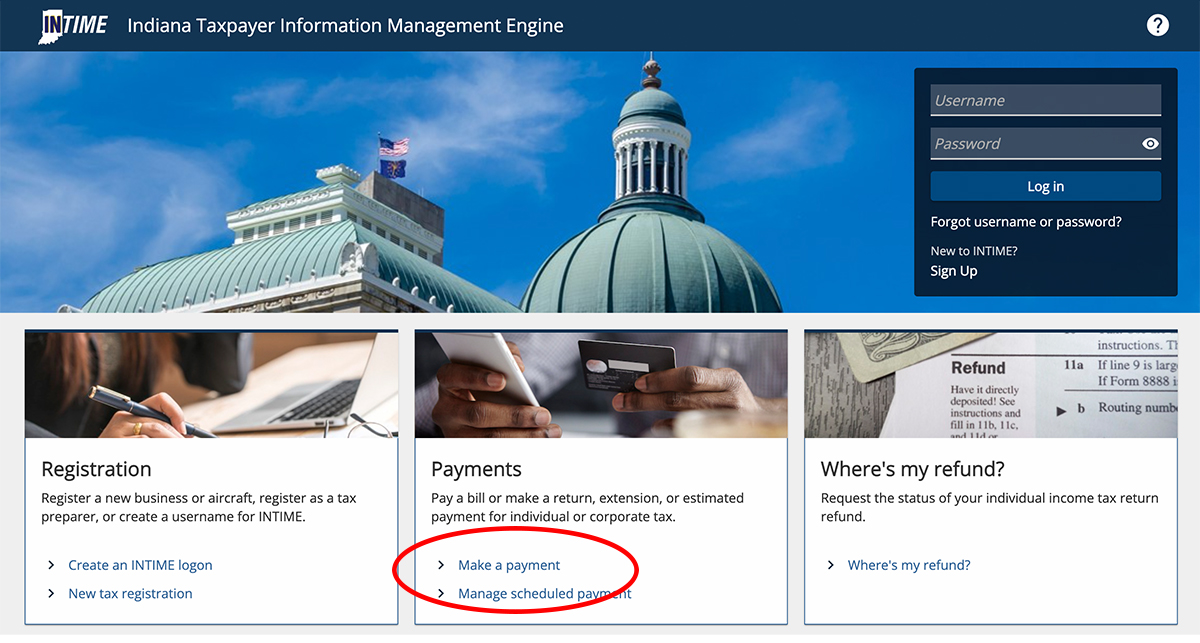

1) Visit the InTime website (Click here).

2) Click “Make a payment.”

3) Under “Non-bill payments,” choose from “Bank payment (no fee).”

4) Choose “Business” when asked, “Are you making a payment for your business tax accounts or your individual tax accounts?”

5) Input FEIN number, legal name, account type (s-corp or partnership), and payment type. *When selecting payment type, you’ll want to select “Composite Withholding (IT-6WTH).”

6) Input contact and address info.

7) Input banking information.

8) Under “Payment,” select the correct “Filing period end-date” you’re making the payment for (ex: 1-Dec-2022) and the amount. Make sure to also confirm the payment date for the day you wish the payment to come out of your account.

9) From there, you can confirm and submit the payment. By paying the pass through entity tax, you have made a payment through the business name and business ID# instead of under the individual.

If you have any questions, please contact us. Click here for contact info.

Blog by Kim Storen, EA – Tax Services Manager

Learn more about Kim and the rest of the Storen Financial team here.