Training programs designed to boost your business!

In order to help our business clients become better businesses, we’ve developed training courses aimed at isolating the most commonly asked questions.

Training programs designed to boost your business!

In order to help our business clients become better businesses, we’ve developed training courses aimed at isolating the most commonly asked questions.

BENEFITS OF OUR Programs

Helping to Build Better Businesses in our Community

Our goal at Storen Financial is to help our business clients become more efficient, more profitable, and all around better businesses. We aim to be your go-to resource in our community.

With those goals in mind, we’ve developed training courses aimed at isolating the most commonly asked questions and setting your business up for future success.

Improve Efficiencies

Save time and money by managing finances systematically, allowing you to focus on running your business.

Avoid Costly Mistakes

Bookkeeping errors are a common occurance. Learn the tips to streamline and improve accuracy.

Identify Opportunities

Gain knowledge to help understand financial statements in order to isolate future growth opportunities.

Customize Your Experience

Choose your path and get answers to questions in a small group environment.

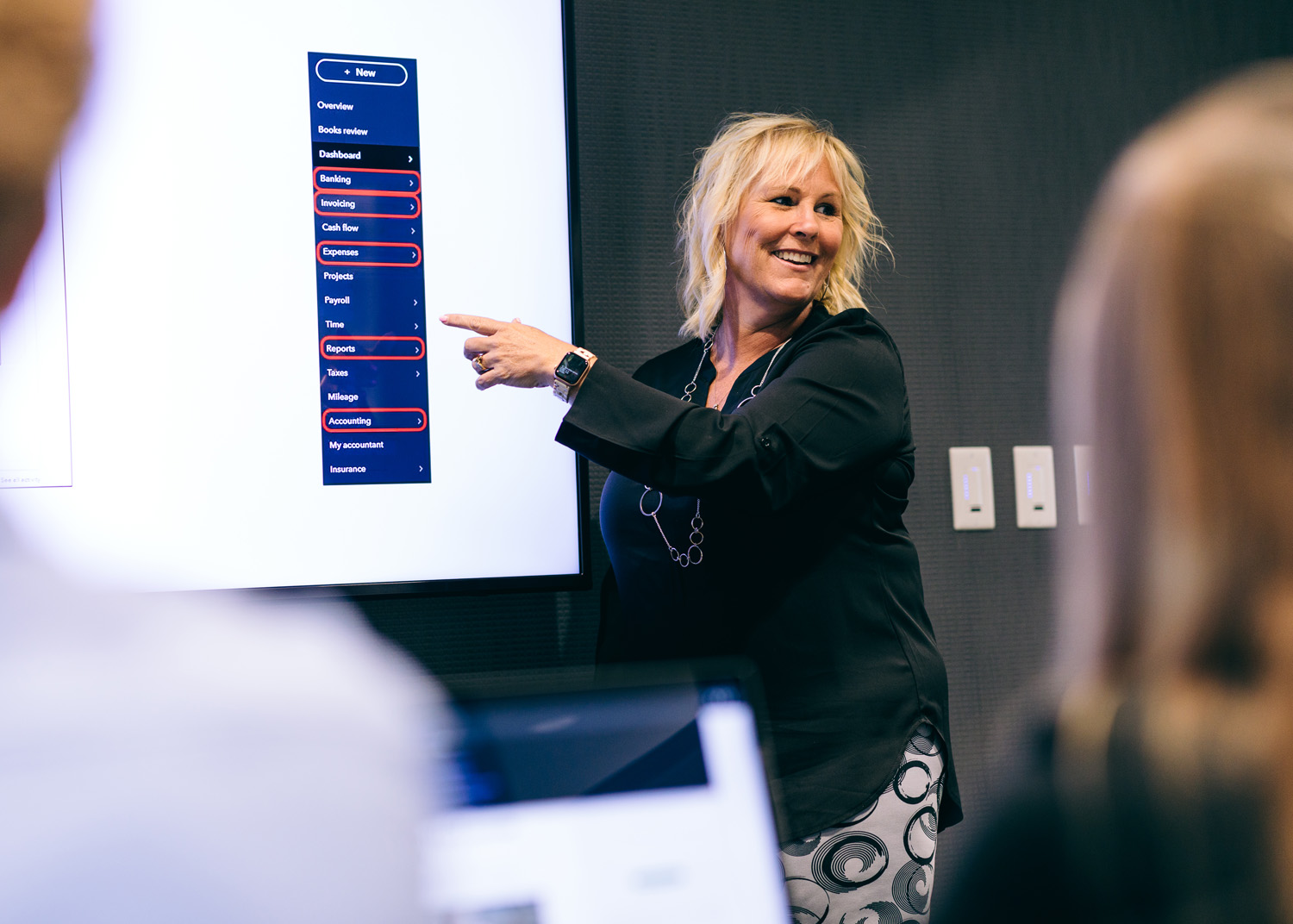

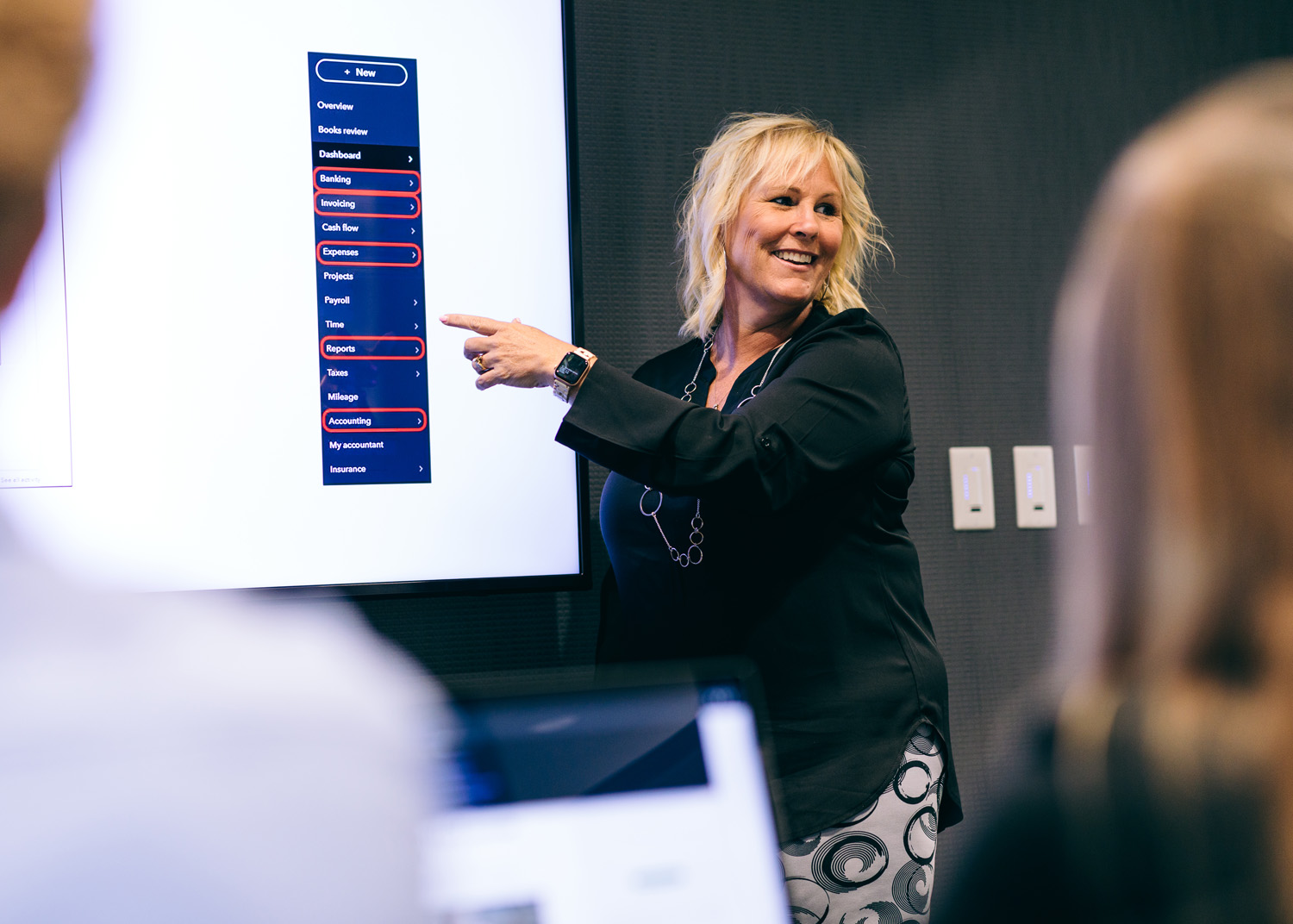

Learn from our QuickBooks Advanced Certified ProAdvisor

Erika’s goal is to work with clients to help ensure they have an accurate and easy to understand picture of their financial status. As an Intuit QuickBooks Advanced Certified ProAdvisor, Erika has a passion for educating clients on best practices and to ease the stress of bookkeeping and financial reporting.

She hopes to help clients solve their business challenges through effective protocols, technology and training.

Erika Lewis

Business Services DIRECTOR

AVAILABLE PROGRAMS

Intro to QuickBooks Online

- In-person Classes

- Small Group Setting

- Condensed Timeline (2-3 hours)

- Local Resource

$350

Who should attend?

Whether you’re a business owner or bookkeeper looking to brush up on specific functionalities, transitioning from desktop to online, or navigating QuickBooks Online for the first time, this is the perfect class to get started.

What do you need?

What will you learn?

Understanding Your Financials

Led by our Business Services Director, this unique training environment will allow you to learn not just how to increase sales but to reduce cost, shift where you’re spending your money, or a combination of all three.

- In-person Classes

- Small Group Setting

- Condensed Timeline (2-3 hours)

- Local Resource

$250

Who should attend?

Business owners who want to increase their profit and dive deeper into the Profit and Loss Statement and Balance Sheet will want to attend this class.

What do you need?

You’ll just need to bring a notebook, pen, and yourself! Any materials needed will be provided for you.

What will you learn?

QuickBooks Online Workshops

$250

Who should attend?

What do you need?

Only your laptop and a list of questions to be answered.

How can we help?

At Storen Financial, we offer so much more than tax preparation and accounting services. We go beyond the numbers to provide our clients with financial planning, in-depth consulting, and year-round support. Looking for more info? Click below to learn more.

LEARN MORE

Read the latest news for businesses on our blog

Storen Team Members as Featured Presenters at Synergy Conference

Showcasing our depth of knowledge and commitment to advancing financial planning strategies Storen Financial was selected this year to lead two impactful educational sessions at the prestigious Thomson Reuters November Synergy Conference in Orlando. This annual,...

Plan Ahead with Our Business Services Calendar

Are you prepared to meet your business goals this year? As the year progresses, you’ll want to be thinking about your business goals. Have you prepared and filed your taxes? Are you reviewing your insurance plans or meeting with an accountant? Have you created a...

Tax Season How-to: What to Provide

Information Required to Produce Your Tax Return *Most forms needed to produce your tax return should be issued or available to you prior to January 31st. If filing jointly, please provide forms and information for both the primary taxpayer and spouse. Below is...