Our Services

Our team of trusted professionals implement tax-saving strategies to help individual and business clients pursue financial goals. With expertise in investing, IRAs, financial planning, tax preparation, and accounting, we offer services that cover all areas of your financial concerns under one roof.

COMPREHENSIVE SERVICES

Tax-Saving Strategies for Individuals and Businesses

Our goal at Storen Financial is to create a customized plan for each client tailored to your unique situation. Our team of trusted professionals will implement tax-saving strategies focused on advising you with a solid financial plan for your future.

With expertise in investing, tax preparation, and accounting, we offer services that cover all areas of your financial concerns.

Financial Planning & Investments

Wealth management solutions focused on helping minimize tax.

Business Services & Training

Processes to streamline accounting, project value, manage expenses, and take full advantage of tax strategies.

Tax Planning & Preparation

Minimize tax liabilities and project future opportunities in a complex tax environment.

Medicare Advisory Services

Understand how to maximize Medicare benefits, as well as evaluate and review options.

Video: Learn more about our services, team, and core values

Kim: “I feel like we have such a great story. We have such a great team and so many ways to help clients that I’m always excited for people to call and come and just meet us and find out what we can do for them.”

WEALTH MANAGEMENT

Financial Planning & Investment Services

- Retirement Planning

- Income Distribution

- Roth IRA Conversions

- Wealth Transfer Strategies

- Charitable Giving Strategies

- Investment Portfolios

- Family Wealth Management

- Estate Planning

- Long Term Care Planning

- Social Security Planning

COMPLEX STRATEGIES

Tax Planning & Preparation

- Individual Tax Returns

- Business Tax Returns

- Tax Projections

- Tax Advising and Consulting

- Amendments

- Extensions

- IRS/State Notifications

- and more…

GO-TO RESOURCE

Business Services & Training

No matter where you stand on your journey of business ownership, we offer comprehensive services to propel you towards success.

- Business Advisory and Consulting Services

- Accounting and Bookkeeping

- Business Startup Services

- Employer-Sponsored Retirement Plans

- Education and Training Programs

BENEFIT NAVIGATION

Medicare Advisory Services

Our goal is to help individuals coming on to Medicare understand what options they have, as well as help those already on Medicare understand how their benefits work. Ruth Hoffman, Storen’s Medicare Benefits Specialist with over 20 years Medicare experience, will work with you one-on-one to help you navigate the Medicare puzzle. Learn more about Ruth here.

Medicare beneficiaries in Indiana have Medicare options beyond Original Medicare Part A and Part B. You can receive your coverage through Original Medicare (with or without a Medicare Supplement plan offered by a private insurer), or through an alternative means, by enrolling in a Medicare Advantage plan, offered by a Medicare-approved private insurance company. You can also enroll in a Medicare plan offered by a private insurance company contracted with Medicare to provide prescription drug coverage.

Schedule a No-Cost Medicare Consultation

- Evaluate how you are currently utilizing healthcare services.

- Review medications being prescribed to determine which prescription plan will best meet your needs.

- Explain what healthcare options are available to the Medicare beneficiary based on needs.

- Explain what financial responsibility may be based on your final healthcare plan selection.

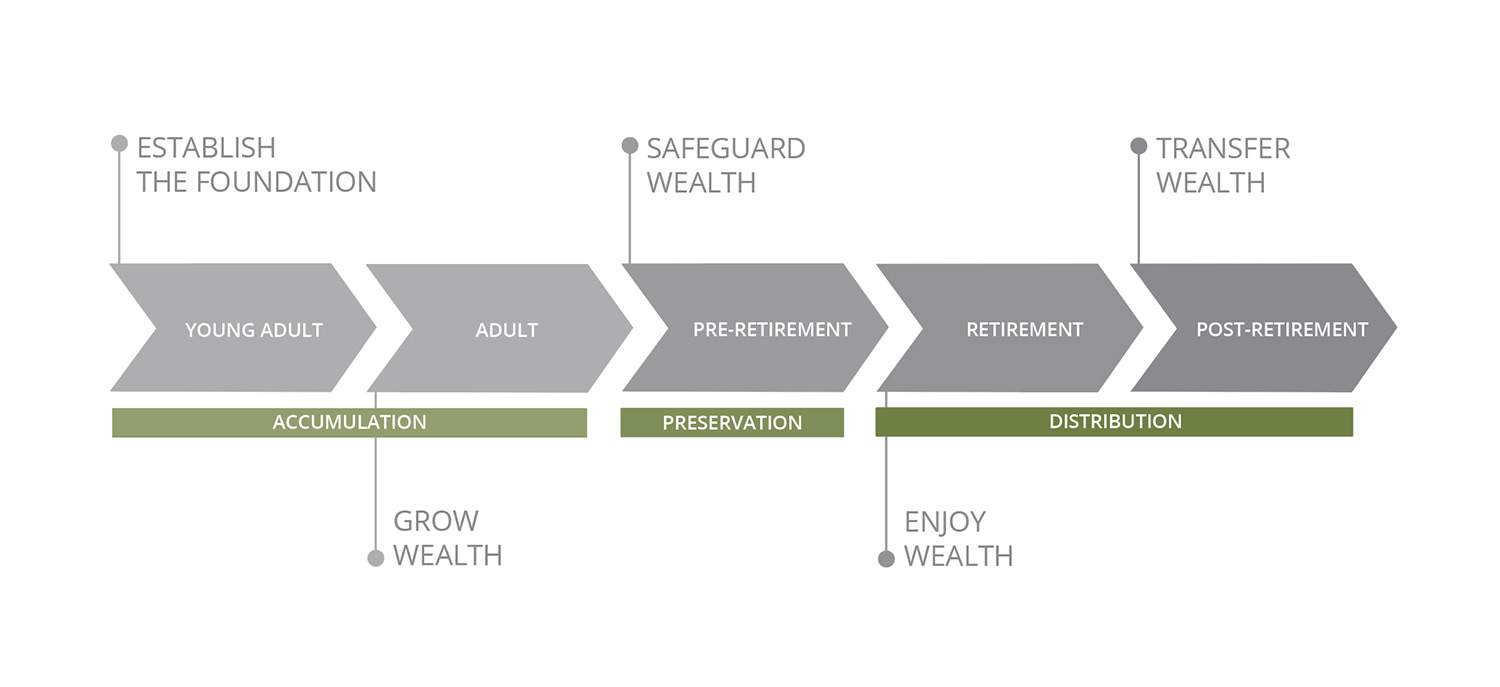

Resources to help no matter where you are along your financial journey.

This resource provides financial recommendations through various stages of life, for young adults through post-retirement. Click here to access this guide.

How can we help?

At Storen Financial, we offer so much more than tax preparation and accounting services. We go beyond the numbers to provide our clients with financial planning, in-depth consulting, and year-round support. Looking for more info? Click below to learn more.

LEARN MORE

Read the latest news and resources on our blog

November 2024 Newsletter

Have you read our November Newsletter? Our monthly newsletters are packed with educational resources for financial planning and retirement, business services, and tax preparation and planning. Stay up-to-date on hot topics and new regulations as well as upcoming...

Video: Top Three Tips for Year-End Processes

VIDEO: Click here to watch on YouTube. Business Accountant, Jessica Gentry, shares her top three tips for business owners' year-end processes. Join us as Communications Specialist, Kaylee Kriese, travels around the office in search of quick answers and helpful...

Case Study: Inherited IRA Mistake Cost Years of Tax-Free Growth

Understanding How Inherited IRA Rules Impact Taxes is Essential to Wealth Management Oftentimes, new clients come to us after realizing they or a previous financial advisor missed a crucial action step that would have maximized their tax savings. One such situation...